Legal Transfer-on-Death Deed Template for Maine

The Transfer-on-Death Deed (TODD) form in Maine represents a significant advancement in estate planning, offering individuals a straightforward mechanism to transfer real property upon their death without the complications of probate. This legal tool allows property owners to designate one or more beneficiaries who will automatically receive the property, ensuring a seamless transition of ownership. By executing a TODD, individuals can maintain full control over their property during their lifetime, as the deed does not take effect until their passing. Importantly, this form is revocable, meaning that property owners can change their beneficiaries or even cancel the deed altogether if their circumstances or intentions change. The simplicity of the process is appealing, as it requires minimal formalities, yet it is essential for individuals to understand the implications of their choices, including how the deed interacts with other estate planning documents. Overall, the Maine Transfer-on-Death Deed form serves as a valuable option for those seeking to simplify the transfer of property and provide for their loved ones in a thoughtful manner.

Dos and Don'ts

When filling out the Maine Transfer-on-Death Deed form, it is essential to approach the process with care. This legal document allows property owners to designate a beneficiary who will receive their property upon their death, without going through probate. Here is a list of things you should and shouldn't do to ensure that your form is completed correctly.

- Do ensure that you are eligible to use a Transfer-on-Death Deed in Maine. Only property owners can create this deed.

- Do provide accurate property descriptions. Clearly identify the property you wish to transfer, including its address and parcel number.

- Do include the full legal names of all parties involved. This includes both the property owner(s) and the designated beneficiary.

- Do sign the deed in front of a notary public. This step is crucial to validate the document and ensure it is legally binding.

- Don't leave any fields blank. Each section of the form must be completed to avoid delays or issues with the deed's validity.

- Don't forget to check state-specific requirements. Different states may have unique rules regarding Transfer-on-Death Deeds.

- Don't use ambiguous language when describing the property or beneficiaries. Clarity is key to preventing misunderstandings in the future.

- Don't forget to file the deed with the appropriate county registry of deeds. This step is necessary for the deed to take effect.

By following these guidelines, you can help ensure that your Transfer-on-Death Deed is completed correctly and serves its intended purpose effectively.

Key takeaways

Filling out and using the Maine Transfer-on-Death Deed form can be a straightforward process if you keep a few key points in mind. Here are some essential takeaways to consider:

- Eligibility: Only property owners can create a Transfer-on-Death Deed. Ensure you are the sole owner or a co-owner of the property.

- Property Description: Clearly describe the property you wish to transfer. Include the address and any relevant identifying details.

- Beneficiary Designation: You must designate one or more beneficiaries who will receive the property upon your death. Choose someone you trust.

- Revocability: The Transfer-on-Death Deed can be revoked at any time before your death. Keep this in mind if your circumstances change.

- Witness Requirement: The deed must be signed in the presence of two witnesses. This step is crucial for the document’s validity.

- Notarization: Although not mandatory, having the deed notarized can provide an extra layer of protection and authenticity.

- Filing the Deed: After completing the form, file it with the appropriate county registry of deeds. This step is essential for the deed to take effect.

- Tax Implications: Understand any potential tax implications for your beneficiaries. Consulting a tax professional may be beneficial.

- Consultation: Consider seeking legal advice if you have questions or concerns about the process. A lawyer can help ensure everything is in order.

By keeping these points in mind, you can navigate the process of creating a Transfer-on-Death Deed in Maine more confidently.

Instructions on Filling in Maine Transfer-on-Death Deed

Once you have the Maine Transfer-on-Death Deed form, you can proceed with filling it out. This deed allows you to designate a beneficiary who will receive your property upon your passing. Follow the steps below to complete the form accurately.

- Begin by entering the name of the property owner in the designated section.

- Provide the address of the property. This includes the street number, street name, city, and zip code.

- List the legal description of the property. This may be found on your property tax statement or deed.

- Identify the beneficiary or beneficiaries. Include their full names and addresses.

- Indicate whether the beneficiaries will share the property equally or specify the percentage each will receive.

- Sign and date the form. Ensure that you are the property owner signing the deed.

- Have the form notarized. This step is crucial for the deed to be legally binding.

- File the completed form with the appropriate county registry of deeds. Check for any filing fees that may apply.

After submitting the form, it will be recorded and become part of the public record. Ensure that you keep a copy for your records and inform your beneficiaries about the deed.

Other Maine Forms

Maine Prenup Contract - This form can help prevent disputes over finances in the event of a separation.

Getting started with your business in Washington is simplified by utilizing the necessary documentation, including the key Articles of Incorporation form. This form is crucial for defining your corporation's identity and operational intent, ensuring your venture is built on a solid legal framework.

Maine Medical Power of Attorney - A Living Will is a vital part of responsible life planning for adults.

Learn More on This Form

-

What is a Transfer-on-Death Deed in Maine?

A Transfer-on-Death Deed (TODD) is a legal document that allows property owners in Maine to designate beneficiaries who will receive their real estate upon the owner’s death. This deed helps avoid probate, making the transfer of property simpler and more efficient for the beneficiaries.

-

Who can use a Transfer-on-Death Deed?

Any individual who owns real estate in Maine can use a Transfer-on-Death Deed. This includes homeowners and individuals holding property in their name. However, joint owners must agree on the transfer, and it’s important to consult with a professional if there are multiple owners.

-

How do I complete a Transfer-on-Death Deed?

To complete a Transfer-on-Death Deed, you need to fill out the form with your information, the property details, and the names of the beneficiaries. It must be signed in front of a notary public. After signing, the deed should be recorded at the local registry of deeds to be legally effective.

-

Can I revoke a Transfer-on-Death Deed?

Yes, a Transfer-on-Death Deed can be revoked. To do this, you must create a new deed that explicitly states the revocation or simply execute a new TODD that names different beneficiaries. It’s essential to record the revocation at the local registry of deeds to ensure it is recognized.

-

What happens if I don’t name a beneficiary?

If you do not name a beneficiary on your Transfer-on-Death Deed, the property will become part of your estate upon your death. This means it will go through probate, which can be a lengthy and costly process for your heirs.

-

Are there any tax implications with a Transfer-on-Death Deed?

Generally, there are no immediate tax implications when you create a Transfer-on-Death Deed. However, the property may be subject to estate taxes upon your death. It’s advisable to consult with a tax professional to understand any potential tax consequences for your beneficiaries.

PDF Form Information

| Fact Name | Details |

|---|---|

| Definition | A Transfer-on-Death (TOD) deed allows an individual to transfer real property to a beneficiary upon their death without going through probate. |

| Governing Law | The TOD deed in Maine is governed by Title 33, Chapter 6, Subchapter 4 of the Maine Revised Statutes. |

| Eligibility | Any individual who owns real property in Maine can create a TOD deed. |

| Beneficiary Designation | Multiple beneficiaries can be named in a TOD deed, and they can inherit the property simultaneously or in succession. |

| Revocation | A TOD deed can be revoked at any time by the grantor through a written document that complies with state requirements. |

| Execution Requirements | The deed must be signed by the grantor and must be witnessed by two individuals or acknowledged before a notary public. |

| Filing | The completed TOD deed must be recorded in the registry of deeds in the county where the property is located to be effective. |

| Tax Implications | Transfer-on-Death deeds do not trigger gift taxes; however, estate taxes may apply depending on the total value of the estate at the time of death. |

Documents used along the form

The Maine Transfer-on-Death Deed form allows property owners to transfer their real estate to designated beneficiaries upon their death, avoiding probate. Several other documents may accompany this form to ensure a smooth transition of property ownership and to clarify intentions. Below is a list of common forms and documents that are often used alongside the Transfer-on-Death Deed in Maine.

- Will: A legal document that outlines how a person's assets should be distributed after their death. It can complement the Transfer-on-Death Deed by addressing any assets not covered by it.

- Boat Bill of Sale: This document serves as a receipt for the sale of a boat or watercraft, outlining essential details such as buyer and seller information, boat description, and sale price. It's crucial for establishing ownership and ensuring a smooth transfer of the vessel. For more information, you can refer to Templates and Guide.

- Beneficiary Designation Form: This form is used for financial accounts and insurance policies. It specifies who will receive these assets upon the owner's death, similar to the Transfer-on-Death Deed for real estate.

- Power of Attorney: This document allows a designated individual to make decisions on behalf of the property owner while they are alive. It ensures that someone can manage the property if the owner becomes incapacitated.

- Property Title: The legal document that shows ownership of the property. It is essential to have the title updated to reflect the Transfer-on-Death Deed to ensure the beneficiaries have clear ownership.

- Affidavit of Heirship: This document can help establish the heirs of a deceased person. It may be used if there are questions about the transfer of property and can clarify the intentions of the deceased.

- Deed of Distribution: This document is used to formally transfer property to the beneficiaries. It may be necessary if the Transfer-on-Death Deed needs to be supplemented or if specific conditions apply.

Using these documents in conjunction with the Maine Transfer-on-Death Deed can help ensure that property is transferred smoothly and according to the owner's wishes. It is advisable to consult with a legal professional to ensure all forms are completed correctly and meet state requirements.

Misconceptions

Understanding the Maine Transfer-on-Death Deed can be tricky. Many people hold misconceptions that can lead to confusion or poor decision-making. Here are nine common misconceptions about this important legal tool:

- It's the same as a will. A Transfer-on-Death Deed is not a will. It allows property to pass directly to a beneficiary upon death, avoiding probate, while a will goes through the probate process.

- It can only be used for real estate. While primarily used for real estate, it can also be applied to other types of property, depending on state laws.

- It’s irrevocable once signed. A Transfer-on-Death Deed can be revoked or changed at any time before the property owner’s death, as long as the proper procedures are followed.

- Beneficiaries automatically inherit all debts. Beneficiaries do not inherit the deceased's debts. The property can be transferred free of certain liabilities, but debts may need to be settled first.

- It requires court approval. Unlike a will, a Transfer-on-Death Deed does not require court approval or probate, making the transfer process quicker and simpler.

- Only one beneficiary can be named. Multiple beneficiaries can be designated in a Transfer-on-Death Deed, allowing for shared ownership among heirs.

- It’s only for those with large estates. This deed is beneficial for anyone who wants to ensure their property passes directly to loved ones, regardless of the estate's size.

- It’s only valid if notarized. While notarization is recommended for validity, Maine law allows for a Transfer-on-Death Deed to be valid if it is signed and recorded, even without a notary.

- It eliminates the need for a will. Even with a Transfer-on-Death Deed in place, having a will is still important for other assets and to express wishes regarding guardianship and other matters.

By clearing up these misconceptions, individuals can make informed decisions about their estate planning and ensure their wishes are honored after their passing.

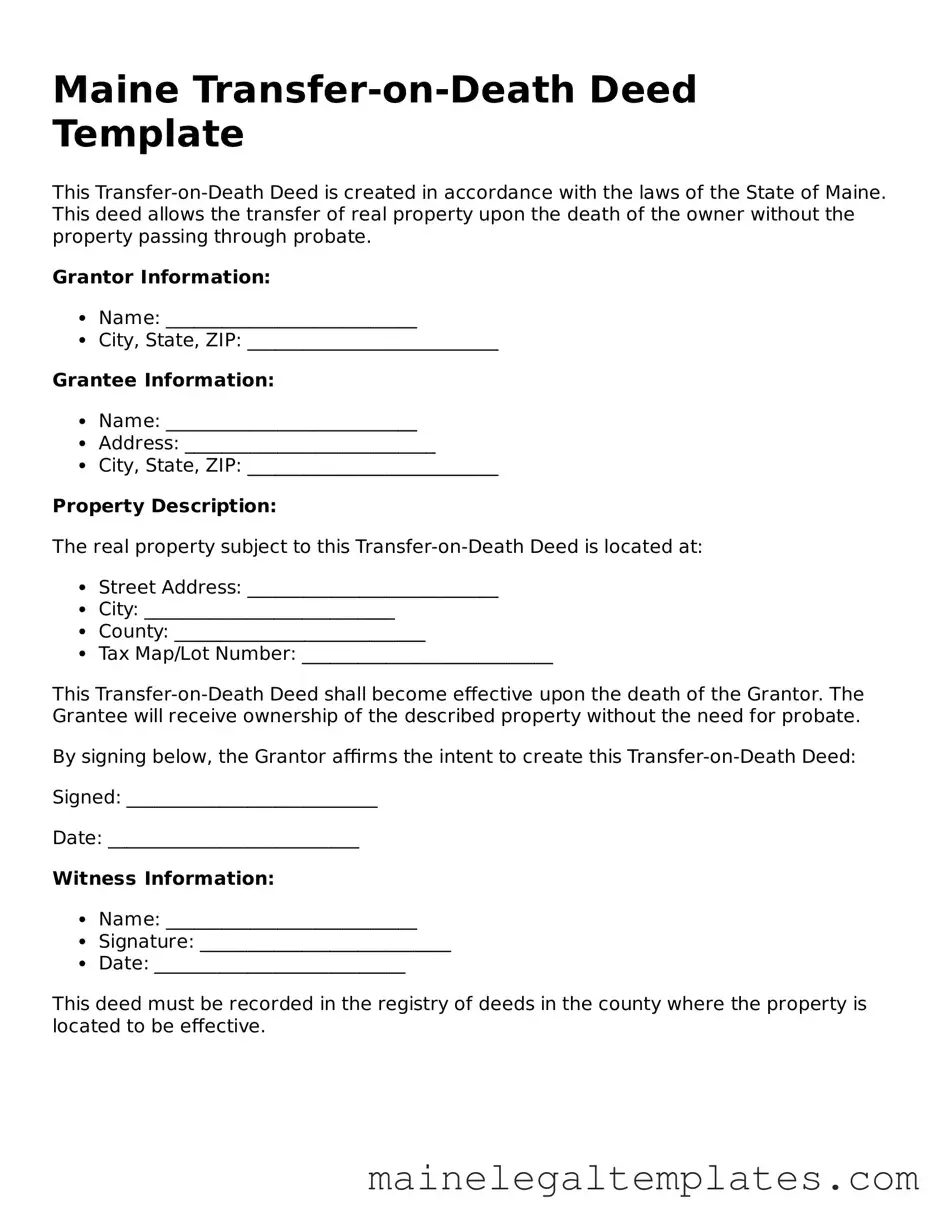

Document Preview

Maine Transfer-on-Death Deed Template

This Transfer-on-Death Deed is created in accordance with the laws of the State of Maine. This deed allows the transfer of real property upon the death of the owner without the property passing through probate.

Grantor Information:

- Name: ___________________________

- City, State, ZIP: ___________________________

Grantee Information:

- Name: ___________________________

- Address: ___________________________

- City, State, ZIP: ___________________________

Property Description:

The real property subject to this Transfer-on-Death Deed is located at:

- Street Address: ___________________________

- City: ___________________________

- County: ___________________________

- Tax Map/Lot Number: ___________________________

This Transfer-on-Death Deed shall become effective upon the death of the Grantor. The Grantee will receive ownership of the described property without the need for probate.

By signing below, the Grantor affirms the intent to create this Transfer-on-Death Deed:

Signed: ___________________________

Date: ___________________________

Witness Information:

- Name: ___________________________

- Signature: ___________________________

- Date: ___________________________

This deed must be recorded in the registry of deeds in the county where the property is located to be effective.