Legal Small Estate Affidavit Template for Maine

In the state of Maine, navigating the complexities of estate management can be daunting, especially during a time of loss. The Maine Small Estate Affidavit provides a streamlined process for settling smaller estates without the need for formal probate proceedings. This legal document is designed for estates valued at $40,000 or less, excluding certain exempt assets, making it an invaluable tool for families and individuals looking to simplify the transfer of property. By using this affidavit, heirs can claim assets directly from financial institutions or other entities, ensuring a quicker resolution and reducing the emotional burden often associated with estate matters. The form requires specific information, including the decedent's details, a list of assets, and the signatures of the heirs, ensuring that all parties are in agreement. Understanding how to properly complete and file this affidavit can significantly ease the process of estate settlement, allowing loved ones to focus on healing rather than legal complexities.

Dos and Don'ts

When filling out the Maine Small Estate Affidavit form, there are important guidelines to follow. Here are four things you should and shouldn't do:

- Do: Ensure that you meet the eligibility requirements for using the Small Estate Affidavit.

- Do: Provide accurate information about the deceased and their assets.

- Don't: Forget to sign and date the affidavit before submitting it.

- Don't: Leave any sections blank; all required fields must be filled out completely.

Key takeaways

The Maine Small Estate Affidavit form is a useful tool for settling the estates of deceased individuals with limited assets. Here are some key takeaways about filling out and using this form:

- The form is designed for estates valued at $40,000 or less, excluding certain assets like real estate.

- Affidavit must be signed under oath, confirming that the information provided is accurate and complete.

- All interested parties, such as heirs and beneficiaries, should be notified before submitting the affidavit.

- Once filed, the affidavit allows the claimant to collect assets directly from institutions or individuals holding the deceased’s property.

Instructions on Filling in Maine Small Estate Affidavit

Once you have the Maine Small Estate Affidavit form ready, you will need to fill it out carefully. This form is used to help settle the estate of a deceased person when the total value of the estate is below a certain threshold. After completing the form, it will need to be filed with the appropriate court, along with any required documentation.

- Begin by entering the full name of the deceased individual at the top of the form.

- Provide the date of death of the deceased. This information is typically found on the death certificate.

- List the address of the deceased at the time of death. This should be the last known residence.

- Indicate the total value of the estate. This should include all assets owned by the deceased, such as bank accounts, real estate, and personal property, but exclude any debts.

- Identify the names and addresses of all heirs. Include anyone who is entitled to inherit from the deceased according to Maine law.

- State whether the deceased left a will. If there is a will, provide details about its location and any relevant information.

- Sign the affidavit in the designated area. Ensure that the signature is dated, as this may be required for validation.

- Have the affidavit notarized. This step is crucial, as a notary public will verify your identity and the authenticity of your signature.

After completing these steps, gather any additional documents that may be required, such as the death certificate or a copy of the will, if applicable. Once everything is ready, file the completed form with the appropriate court in your jurisdiction.

Other Maine Forms

Maine Bureau of Motor Vehicles - You can ensure that someone you designate will act in your best interest regarding your vehicle.

The comprehensive overview of the Employee Handbook provides vital insights into the essential policies and procedures that define the employer-employee relationship in New Jersey. This resource is designed to empower employees with knowledge about their rights and responsibilities, ensuring a better understanding of workplace dynamics.

How to Write a Bill of Sale for a Boat - Can also serve as a receipt for the buyer’s purchase.

Maine Non Resident Atv Registration - Proof of sale for a snowmobile between buyer and seller.

Learn More on This Form

-

What is the Maine Small Estate Affidavit?

The Maine Small Estate Affidavit is a legal document that allows individuals to settle the estate of a deceased person without going through the formal probate process. This option is available when the total value of the deceased's assets falls below a certain threshold, which is currently set at $40,000 for individual estates and $80,000 for joint estates.

-

Who can use the Small Estate Affidavit?

Any individual who is a beneficiary or heir of the deceased can use the Small Estate Affidavit. This includes family members such as spouses, children, or siblings. However, the estate must meet the value requirements for the affidavit to be applicable.

-

What assets can be included in the Small Estate Affidavit?

The affidavit can include various types of assets, such as bank accounts, personal property, and real estate. However, certain assets, like life insurance policies with designated beneficiaries or retirement accounts, may not be included as they pass directly to the named beneficiaries.

-

How do I complete the Small Estate Affidavit?

To complete the Small Estate Affidavit, you will need to fill out the form accurately, providing information about the deceased, the assets, and the heirs. It is important to ensure that all details are correct. Once completed, the affidavit must be signed in front of a notary public.

-

Do I need to file the Small Estate Affidavit with the court?

No, the Small Estate Affidavit does not need to be filed with the court. However, you may need to present it to financial institutions or other entities holding the deceased's assets to claim them.

-

Are there any fees associated with using the Small Estate Affidavit?

There are generally no court fees for using the Small Estate Affidavit. However, you may incur costs for notarization or obtaining copies of the affidavit. It's advisable to check with local institutions for any specific requirements they may have.

-

What happens if the estate exceeds the small estate limit?

If the estate's value exceeds the limit, you will need to go through the formal probate process. This process is more complex and may require the assistance of an attorney. It involves filing a petition with the probate court and following the court's procedures for settling the estate.

PDF Form Information

| Fact Name | Details |

|---|---|

| Purpose | The Maine Small Estate Affidavit allows heirs to claim property without formal probate for small estates. |

| Eligibility | The estate must have a total value of $40,000 or less, excluding certain assets. |

| Governing Law | This affidavit is governed by Title 18-A, Section 3-1201 of the Maine Revised Statutes. |

| Required Information | Heirs must provide details about the deceased, including name, date of death, and a list of assets. |

| Filing Process | The completed affidavit must be filed with the appropriate probate court in Maine. |

| Signature Requirement | All heirs must sign the affidavit, affirming their relationship to the deceased. |

| Timeframe | The affidavit can be submitted immediately after the death, but all debts must be settled first. |

| Use of Affidavit | This form can be used to transfer bank accounts, real estate, and personal property without probate. |

Documents used along the form

When dealing with the probate process in Maine, especially for small estates, several forms and documents may accompany the Maine Small Estate Affidavit. Each of these documents serves a specific purpose and can help streamline the process of settling an estate. Below is a list of common forms used alongside the Small Estate Affidavit.

- Death Certificate: This official document confirms the death of the individual whose estate is being settled. It is essential for proving the decedent's passing and is often required when filing other estate documents.

- Will: If the decedent left a will, it must be submitted along with the Small Estate Affidavit. The will outlines the decedent's wishes regarding asset distribution and may impact how the estate is handled.

- Inventory of Assets: This document lists all assets owned by the decedent at the time of death. It helps provide a clear picture of the estate's value and what is to be distributed.

- New York Boat Bill of Sale - This essential document serves as a receipt for the sale of a boat, detailing buyer and seller information, boat description, and sale price, further explained in Templates and Guide.

- Affidavit of Heirship: This form is used to establish the legal heirs of the decedent. It may be necessary when there is no will or when the heirs are not clearly identified.

- Tax Forms: Depending on the estate's size and complexity, certain tax forms may be required. These can include federal estate tax returns or state inheritance tax forms.

- Notice to Creditors: This document informs creditors of the decedent's passing and allows them to make claims against the estate for any debts owed. It is an important step in settling the estate's liabilities.

- Petition for Probate: If the estate is not small enough to qualify for the Small Estate Affidavit, a petition for probate may be necessary. This document formally requests the court to recognize the will and appoint a personal representative.

Understanding these documents can significantly ease the process of settling a small estate in Maine. Each plays a crucial role in ensuring that the decedent's wishes are honored and that the estate is managed according to the law.

Misconceptions

The Maine Small Estate Affidavit form is a useful tool for settling the estates of individuals who have passed away, particularly when their assets are below a certain threshold. However, several misconceptions surround this form that can lead to confusion. Below is a list of common misunderstandings about the Maine Small Estate Affidavit.

- It can be used for any estate. The Small Estate Affidavit is specifically for estates with a total value of less than $40,000. If the estate exceeds this amount, different legal procedures must be followed.

- It eliminates the need for probate. While the Small Estate Affidavit simplifies the process, it does not entirely eliminate the need for probate. It serves as an alternative for smaller estates, making the process more straightforward.

- All debts must be settled before using the affidavit. While it is advisable to address outstanding debts, the affidavit allows heirs to claim assets even if some debts remain unpaid, as long as the estate's value is within the specified limit.

- Only immediate family can use the affidavit. Although immediate family members are typically the ones who file, anyone who has a legal claim to the estate can use the Small Estate Affidavit, provided they meet the necessary requirements.

- It is a complicated form that requires legal assistance. Many individuals find the Small Estate Affidavit to be straightforward and manageable without legal help. However, seeking assistance can still be beneficial for those unfamiliar with the process.

- Filing the affidavit is the final step. Submitting the Small Estate Affidavit is just one step in the process. Once filed, the heirs must also ensure that the assets are transferred correctly and any necessary notifications are made.

- It is only for real estate assets. The Small Estate Affidavit can be used for various types of assets, including bank accounts, personal property, and vehicles, as long as they fall under the value limit.

- The affidavit must be filed in court. Unlike traditional probate proceedings, the Small Estate Affidavit does not require court filing, making it a more accessible option for settling smaller estates.

- It can be used for estates with multiple beneficiaries. The Small Estate Affidavit is designed for estates with a single beneficiary or a small number of beneficiaries. If there are many beneficiaries, other legal processes may be more appropriate.

Understanding these misconceptions can help individuals navigate the process of settling a small estate in Maine more effectively. By clarifying the facts surrounding the Small Estate Affidavit, individuals can make informed decisions and avoid potential pitfalls.

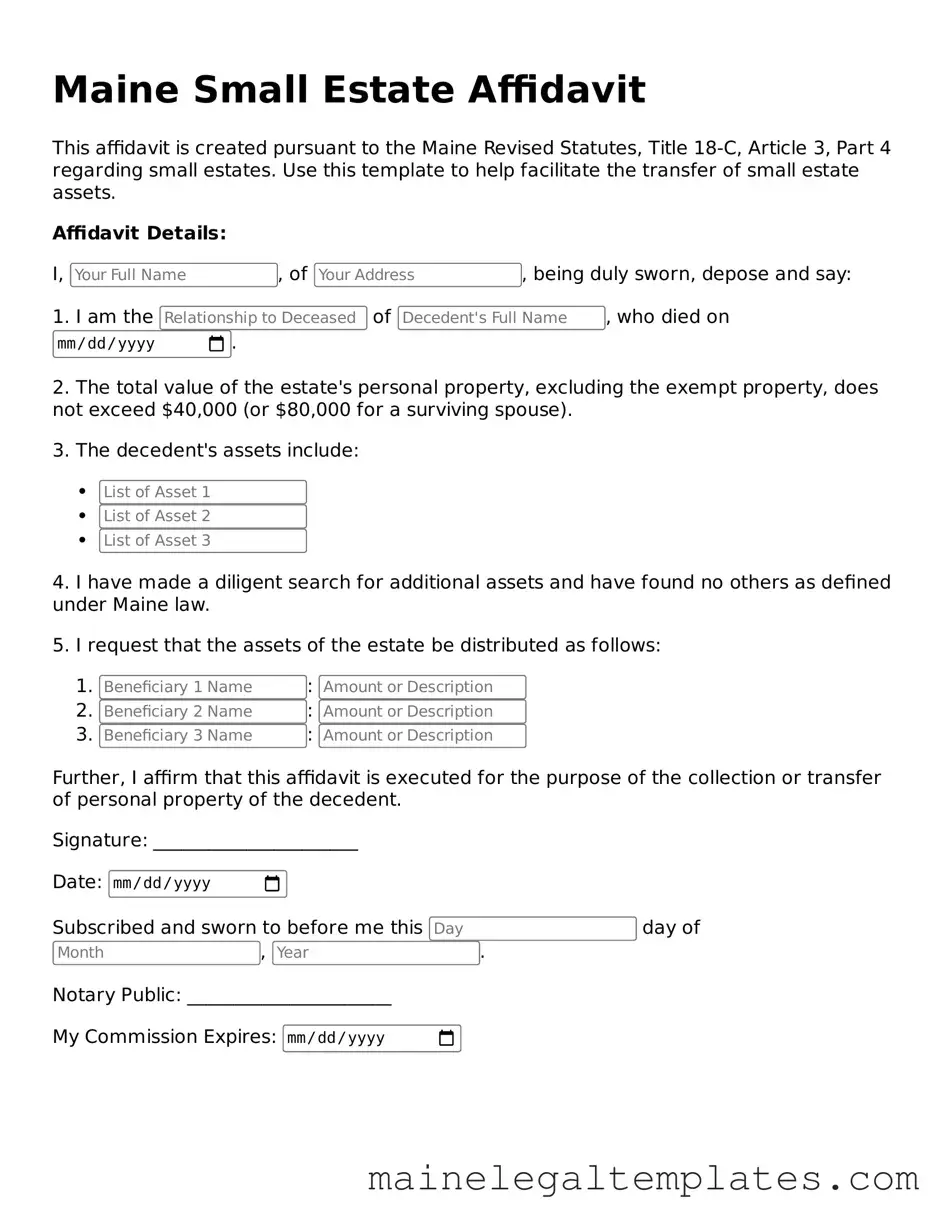

Document Preview

Maine Small Estate Affidavit

This affidavit is created pursuant to the Maine Revised Statutes, Title 18-C, Article 3, Part 4 regarding small estates. Use this template to help facilitate the transfer of small estate assets.

Affidavit Details:

I, , of , being duly sworn, depose and say:

1. I am the of , who died on .

2. The total value of the estate's personal property, excluding the exempt property, does not exceed $40,000 (or $80,000 for a surviving spouse).

3. The decedent's assets include:

4. I have made a diligent search for additional assets and have found no others as defined under Maine law.

5. I request that the assets of the estate be distributed as follows:

- :

- :

- :

Further, I affirm that this affidavit is executed for the purpose of the collection or transfer of personal property of the decedent.

Signature: ______________________

Date:

Subscribed and sworn to before me this day of , .

Notary Public: ______________________

My Commission Expires: