Legal Promissory Note Template for Maine

In the state of Maine, a Promissory Note serves as a vital financial instrument that outlines the terms of a loan agreement between a borrower and a lender. This document details the amount borrowed, the interest rate, and the repayment schedule, ensuring clarity and legal protection for both parties involved. It is essential for the Promissory Note to include specific information, such as the names and addresses of the borrower and lender, the principal amount, and the maturity date, as well as any provisions for late payments or default. Additionally, the form may specify whether the loan is secured or unsecured, which significantly impacts the rights of the lender in the event of non-payment. Understanding these key components is crucial for anyone considering entering into a loan agreement in Maine, as it not only formalizes the transaction but also helps prevent potential disputes down the line.

Dos and Don'ts

When filling out the Maine Promissory Note form, it’s important to follow certain guidelines to ensure accuracy and compliance. Here’s a list of what to do and what to avoid:

- Do read the entire form carefully before starting.

- Do provide clear and accurate information.

- Do include the correct names and addresses of all parties involved.

- Do specify the loan amount and interest rate clearly.

- Do state the repayment terms, including due dates.

- Don't leave any sections blank unless instructed.

- Don't use vague language; be specific in your terms.

- Don't forget to sign and date the document.

- Don't alter the form without understanding the implications.

- Don't submit the form without reviewing it for errors.

Key takeaways

When filling out and using the Maine Promissory Note form, there are several important considerations to keep in mind. Here are four key takeaways:

- Clear Identification of Parties: Ensure that both the borrower and lender are clearly identified. This includes full names and addresses to avoid any confusion about who is involved in the agreement.

- Specific Loan Details: Include precise details about the loan amount, interest rate, and repayment schedule. This information is crucial for both parties to understand their obligations.

- Legal Compliance: Make sure the note complies with Maine state laws. This includes adhering to any regulations regarding interest rates and loan terms to ensure the note is enforceable.

- Signatures and Dates: Both parties must sign and date the document. This step is essential for the validity of the promissory note, as it signifies agreement to the terms outlined.

Instructions on Filling in Maine Promissory Note

Once you have the Maine Promissory Note form in front of you, it’s time to begin the process of filling it out. This form will require specific information to ensure it is complete and accurate. Each section has a purpose, and providing the correct details is essential for clarity and legal standing.

- Read the Instructions: Before you start filling out the form, take a moment to read any instructions that accompany it. This will give you a clear understanding of what is required.

- Enter the Date: At the top of the form, write the date on which you are completing the note. This is important for tracking the timeline of the agreement.

- Identify the Borrower: Fill in the full name and address of the person or entity borrowing the money. Ensure that all details are accurate to avoid confusion later.

- Identify the Lender: Next, provide the full name and address of the lender. This is the individual or organization that is providing the funds.

- State the Loan Amount: Clearly indicate the total amount of money being borrowed. This should be written in both numerical and written form to eliminate ambiguity.

- Specify the Interest Rate: If applicable, include the interest rate for the loan. Make sure to state whether it is fixed or variable.

- Outline the Repayment Terms: Describe how and when the borrower will repay the loan. Include details such as the payment schedule, due dates, and any penalties for late payments.

- Signatures: Both the borrower and lender must sign the document. Ensure that the signatures are dated and that each party receives a copy of the completed form.

After filling out the form, review it carefully for any errors or missing information. This will help prevent misunderstandings in the future. Once everything is correct, the signed document can be shared with all parties involved, ensuring everyone is on the same page.

Other Maine Forms

Horse Bill of Sale Form - This form serves as proof of ownership transfer from the seller to the buyer.

The California Lease Agreement form is a crucial document that outlines the terms and conditions between a landlord and tenant for property rental in California. This legally binding agreement ensures that both parties have a clear understanding of their rights and responsibilities throughout the rental period. For those seeking to establish a formal arrangement, a comprehensive Lease Agreement form is essential to avoid any ambiguities and to govern the leasing process effectively.

How to Write a Bill of Sale for a Boat - Works as a safeguard in case of future disputes or misunderstandings.

Divorce Settlement Template - It provides a framework for resolving issues without additional court involvement whenever possible.

Learn More on This Form

-

What is a Maine Promissory Note?

A Maine Promissory Note is a written agreement between a borrower and a lender. It outlines the terms of a loan, including the amount borrowed, interest rate, repayment schedule, and any other conditions. This document serves as a legal record of the debt and the borrower's promise to repay it.

-

Who can use a Promissory Note in Maine?

Any individual or business can use a Promissory Note in Maine. It is commonly utilized by private lenders, friends, family members, or businesses lending money to customers or clients. Both parties must agree to the terms outlined in the note for it to be valid.

-

What are the essential components of a Maine Promissory Note?

A typical Maine Promissory Note includes the following key components:

- The names and addresses of the borrower and lender.

- The principal amount being borrowed.

- The interest rate, if applicable.

- The repayment schedule, including due dates.

- Any late fees or penalties for missed payments.

- Signatures of both parties.

-

Is it necessary to have a lawyer review the Promissory Note?

While it is not legally required to have a lawyer review a Promissory Note, it is often advisable. A legal professional can ensure that the document complies with Maine laws and adequately protects the interests of both parties. This can help prevent disputes in the future.

-

Can a Promissory Note be modified after it has been signed?

Yes, a Promissory Note can be modified after it has been signed, but both parties must agree to the changes. It is important to document any modifications in writing and have both parties sign the amended note to ensure clarity and enforceability.

-

What happens if the borrower defaults on the Promissory Note?

If the borrower defaults, the lender has several options. They may pursue collection efforts, which can include contacting the borrower for payment or negotiating a new repayment plan. If necessary, the lender may also take legal action to recover the owed amount, depending on the terms of the note and state laws.

-

How is a Promissory Note enforced in Maine?

A Promissory Note can be enforced in Maine through legal proceedings if the borrower fails to repay the loan as agreed. The lender may file a lawsuit in a civil court to seek repayment. Having a well-drafted Promissory Note increases the chances of successful enforcement.

PDF Form Information

| Fact Name | Details |

|---|---|

| Definition | A promissory note is a written promise to pay a specific amount of money to a designated person or entity at a specified time. |

| Governing Law | Maine's promissory notes are governed by Title 11, Article 3 of the Maine Revised Statutes. |

| Parties Involved | The note involves two main parties: the maker (borrower) and the payee (lender). |

| Interest Rate | The interest rate can be fixed or variable and must be clearly stated in the note. |

| Payment Terms | Payment terms should specify the amount due, due dates, and the method of payment. |

| Default Clause | A default clause outlines the consequences if the borrower fails to make payments as agreed. |

| Signatures Required | The maker must sign the note for it to be valid; the payee’s signature is not required. |

| Notarization | While notarization is not mandatory in Maine, it can add an extra layer of authenticity. |

| Transferability | Promissory notes are generally transferable, allowing the payee to sell or assign the note to another party. |

| Enforcement | If the borrower defaults, the payee can pursue legal action to recover the owed amount. |

Documents used along the form

When preparing a Maine Promissory Note, several other documents may be required to ensure clarity and legality in the transaction. Each of these forms serves a specific purpose and can help protect the interests of both the borrower and the lender.

- Loan Agreement: This document outlines the terms of the loan, including the amount borrowed, interest rate, repayment schedule, and any collateral involved. It serves as a comprehensive agreement between the parties.

- Lease Agreement: A crucial document that defines the relationship between a landlord and tenant, ensuring that both parties understand their rights and responsibilities. For more information on this, you can refer to Templates and Guide.

- Security Agreement: If the loan is secured by collateral, this document details the specific assets pledged as security for the loan. It protects the lender's rights in case of default.

- Personal Guarantee: This form may be signed by a third party who agrees to be responsible for the loan if the borrower defaults. It provides additional assurance to the lender.

- Disclosure Statement: This document outlines the terms and conditions of the loan in a clear manner. It ensures that the borrower understands their obligations and the costs associated with the loan.

- Payment Schedule: A detailed breakdown of when payments are due, how much each payment will be, and the total repayment period. This helps both parties track the loan’s progress.

- Amendment Agreement: If any terms of the original promissory note need to be changed, this document formally outlines those changes and requires agreement from both parties.

- Default Notice: This document is issued if the borrower fails to meet the repayment terms. It serves as a formal notification of default and may outline the lender's options moving forward.

These documents complement the Maine Promissory Note and help create a clear framework for the lending process. Ensuring all necessary forms are in place can prevent misunderstandings and protect the rights of both parties involved.

Misconceptions

Understanding the Maine Promissory Note form is essential for anyone involved in lending or borrowing money. However, several misconceptions often arise regarding its use and requirements. Below is a list of common misconceptions.

- It must be notarized to be valid. Many believe that a promissory note requires notarization. In Maine, notarization is not a legal requirement for the note to be enforceable, although it can provide additional proof of authenticity.

- Only banks can issue promissory notes. This is incorrect. Individuals, businesses, and organizations can create and issue promissory notes as long as they meet the necessary criteria.

- All promissory notes are the same. Promissory notes can vary significantly in terms of terms, interest rates, and repayment schedules. It is important to tailor the note to the specific agreement between the parties involved.

- Promissory notes do not need to specify a repayment schedule. While some informal notes may not include a repayment schedule, a well-drafted promissory note should clearly outline when and how payments will be made.

- Interest rates on promissory notes must be fixed. This is a misconception. Interest rates can be fixed or variable, depending on the agreement between the lender and borrower.

- Once signed, a promissory note cannot be changed. While it is true that changes to a signed note can be complicated, parties can amend the terms if both agree and document the changes properly.

- Promissory notes are only for large loans. This is not accurate. Promissory notes can be used for loans of any size, from small personal loans to large business transactions.

- A promissory note is the same as a loan agreement. While both documents relate to borrowing money, a promissory note is typically simpler and focuses on the promise to pay, whereas a loan agreement may include more detailed terms and conditions.

- Legal action cannot be taken based on a promissory note. This is incorrect. A promissory note is a legally binding document. If the borrower defaults, the lender can take legal action to recover the owed amount.

Addressing these misconceptions can help individuals navigate the lending process more effectively and ensure that all parties understand their rights and obligations.

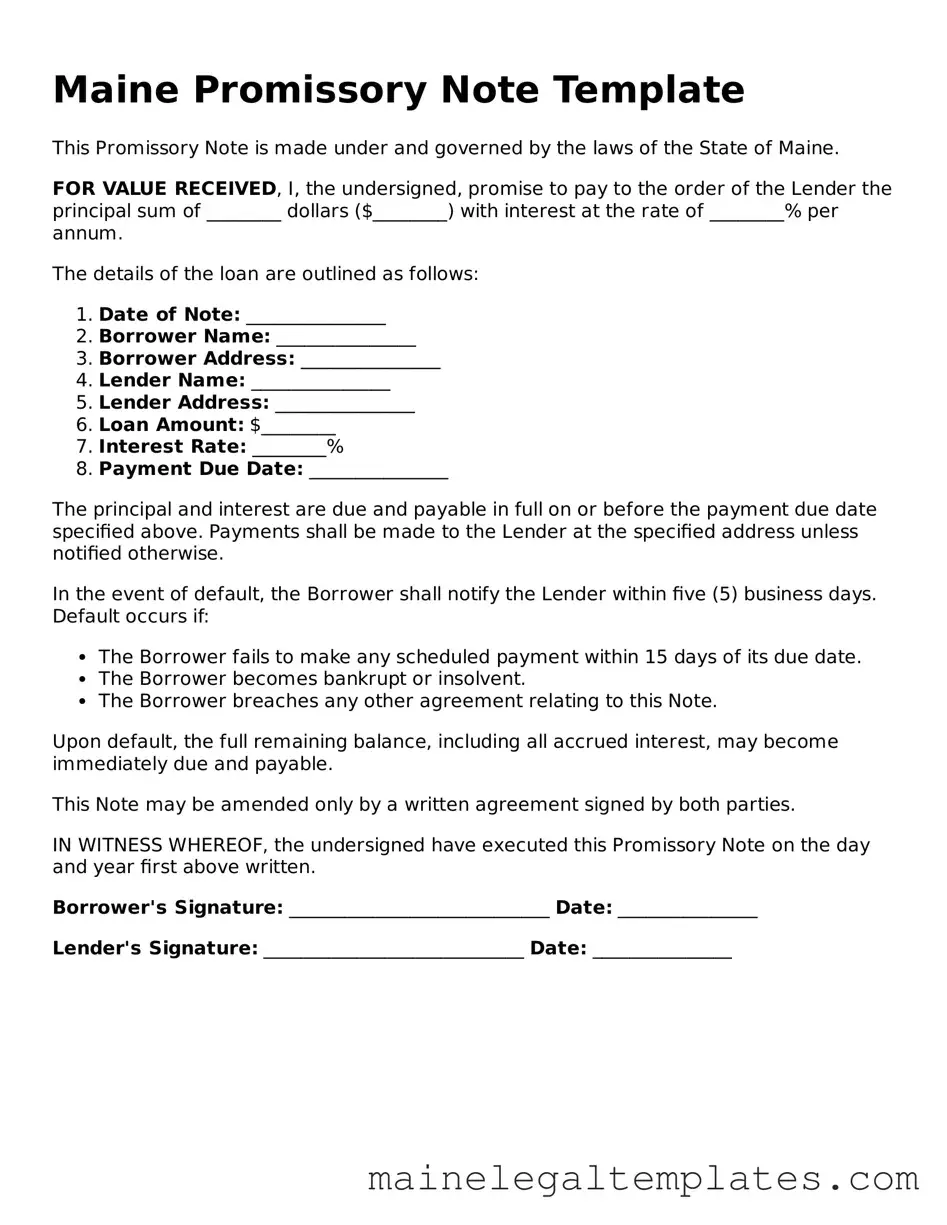

Document Preview

Maine Promissory Note Template

This Promissory Note is made under and governed by the laws of the State of Maine.

FOR VALUE RECEIVED, I, the undersigned, promise to pay to the order of the Lender the principal sum of ________ dollars ($________) with interest at the rate of ________% per annum.

The details of the loan are outlined as follows:

- Date of Note: _______________

- Borrower Name: _______________

- Borrower Address: _______________

- Lender Name: _______________

- Lender Address: _______________

- Loan Amount: $________

- Interest Rate: ________%

- Payment Due Date: _______________

The principal and interest are due and payable in full on or before the payment due date specified above. Payments shall be made to the Lender at the specified address unless notified otherwise.

In the event of default, the Borrower shall notify the Lender within five (5) business days. Default occurs if:

- The Borrower fails to make any scheduled payment within 15 days of its due date.

- The Borrower becomes bankrupt or insolvent.

- The Borrower breaches any other agreement relating to this Note.

Upon default, the full remaining balance, including all accrued interest, may become immediately due and payable.

This Note may be amended only by a written agreement signed by both parties.

IN WITNESS WHEREOF, the undersigned have executed this Promissory Note on the day and year first above written.

Borrower's Signature: ____________________________ Date: _______________

Lender's Signature: ____________________________ Date: _______________