Get Phip Program Maine Form in PDF

The Private Health Insurance Premium (PHIP) Program in Maine offers vital support for MaineCare members who have private health insurance. This program is designed to assist eligible individuals by covering part or all of their monthly health insurance premiums. To qualify for the PHIP benefit, applicants must already have health insurance, either through their employer or as an individual policy. It is important to note that MaineCare will not assist in finding or obtaining health insurance. The PHIP benefit ensures that having private health insurance does not jeopardize a member's MaineCare eligibility. For those enrolled in the Katie Beckett Program, an increase in premiums may occur upon eligibility for PHIP. The reimbursement process is straightforward; the program pays the policyholder directly each month. To determine eligibility for PHIP, applicants must provide specific documentation, including proof of premium costs, employer information, and completed forms such as the W-9 and Direct Deposit Form. The application process requires careful attention to detail, including information about family members covered under the insurance plan. By understanding the PHIP Program's requirements and benefits, MaineCare members can effectively navigate their health insurance options and ensure they receive the financial support they need.

Dos and Don'ts

When filling out the PHIP Program Maine form, it's essential to ensure accuracy and completeness. Here are four important things to do and avoid:

- Do: Fill out the Employer and Insurance Information form completely. Include all requested details, such as the amount you pay for your policy and the frequency of deductions from your paycheck.

- Do: Provide proof of your premium costs. This can be a current pay stub or bill that outlines your insurance expenses.

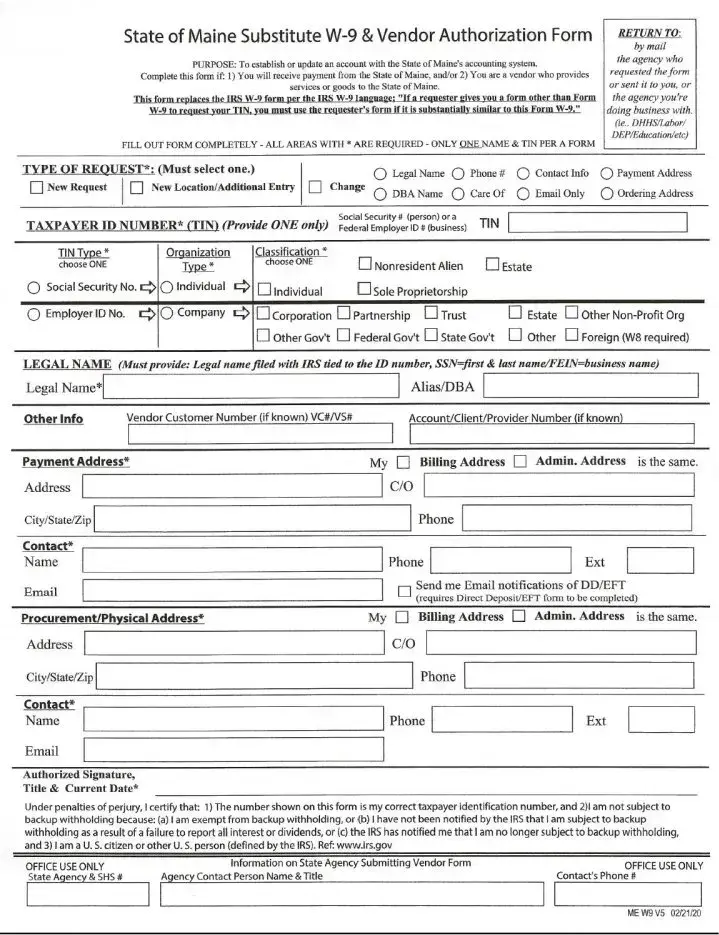

- Do: Ensure you include a completed W-9 form. This is necessary for reimbursement of your monthly premiums.

- Do: List all MaineCare members accurately. Include their names, relationships to the policyholder, MaineCare ID numbers, and dates of birth.

- Don't: Forget to mention open enrollment dates. This information helps the program understand when your costs may change.

- Don't: Leave out any required documents. Missing items can delay your application process.

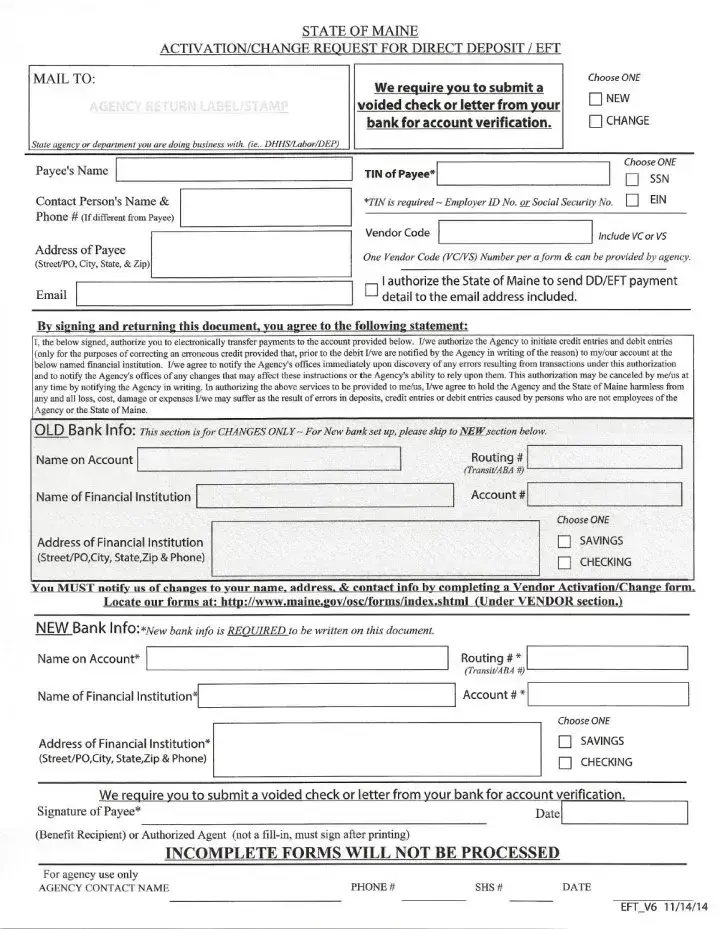

- Don't: Use deposit slips or starter checks for your Direct Deposit Form. A voided check or a letter from your bank is required.

- Don't: Submit your application without reviewing it. Errors can lead to complications or delays in receiving benefits.

Key takeaways

The following are key takeaways for filling out and using the PHIP Program Maine form:

- Eligibility Requirement: You must have private health insurance and be a MaineCare member to qualify for the PHIP benefit.

- Benefit Coverage: PHIP can cover part or all of your monthly health insurance premium without affecting your MaineCare eligibility.

- Payment Method: Payments will be made directly to you, the policyholder, on a monthly basis.

- Required Documentation: Submit an Employer and Insurance Information form, proof of premium costs, and other necessary documents to determine eligibility.

- Open Enrollment: Be aware of your insurance plan's open enrollment period, as it affects when you can change your coverage.

- W-9 Form: The policyholder must complete a W-9 form for reimbursement purposes, but it is not used for tax reporting.

- Direct Deposit: To receive payments, a completed Direct Deposit Form and a voided check or bank letter must be submitted.

Instructions on Filling in Phip Program Maine

After gathering the necessary information, you can begin filling out the PHIP Program Maine form. Ensure that you have all required documents ready for a smooth process. Follow the steps outlined below to complete the form accurately.

- Employer and Insurance Information Form: Fill in all requested details, including the amount you pay for your policy and the frequency of paycheck deductions. Note the open enrollment dates.

- W-9 Form: The policyholder should complete this form. Include only the policyholder's name, address, Social Security number, signature, and date.

- Direct Deposit Form: Ensure the policyholder's name matches the checking or savings account. If using a savings account, attach a letter from the bank with the account and routing numbers.

- MaineCare Participants Form: List the names, relationships to the policyholder, MaineCare ID numbers, and dates of birth for each family member covered by the insurance.

- Documentation: Gather proof of your premium costs, including a current pay stub or bill, insurance rate breakdown, and a copy of your medical and pharmacy insurance card (front and back).

- Submit the Application: Send the completed forms and documentation via mail, email, or fax to the designated office.

Find Popular Forms

Maine Dmv - Extra care should be taken when submitting personal medical information.

To facilitate the buying and selling of an All-Terrain Vehicle (ATV) in New York, a properly completed ATV Bill of Sale is necessary, and you can find a useful template for this at https://nyforms.com/atv-bill-of-sale-template, which helps ensure all required details are included to avoid any misunderstandings in the transaction.

Maine Probate Court Forms - It allows for service by hand delivery or leaving a copy with someone at the defendant's residence.

Learn More on This Form

-

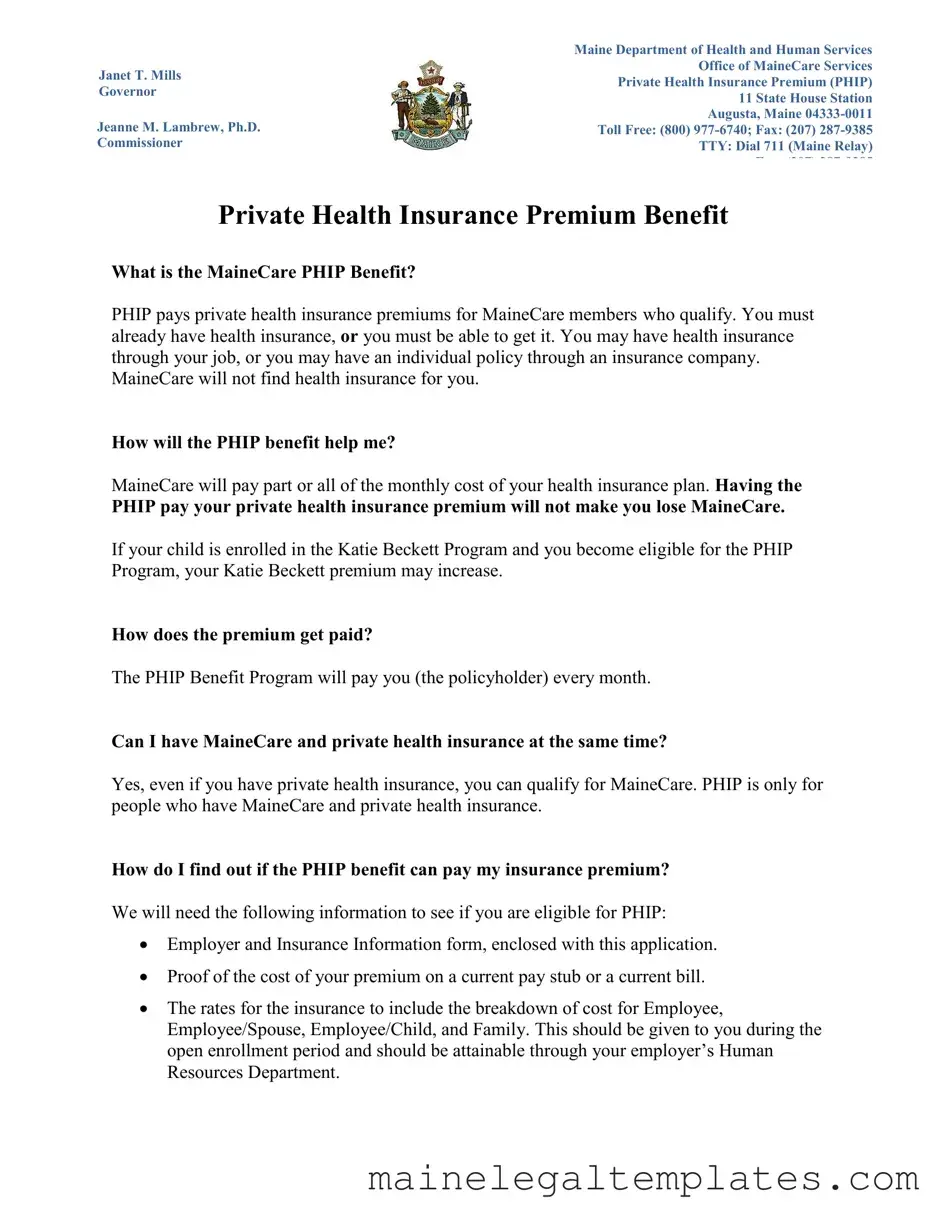

What is the MaineCare PHIP Benefit?

The Private Health Insurance Premium (PHIP) Benefit is a program designed to assist MaineCare members by covering part or all of their private health insurance premiums. To qualify, individuals must already have health insurance or be eligible to obtain it. This insurance can be through an employer or an individual policy. It's important to note that MaineCare does not provide health insurance; it only helps pay for existing plans.

-

How will the PHIP benefit help me?

The PHIP benefit can significantly reduce your out-of-pocket expenses for health insurance. By covering some or all of your monthly premiums, it ensures that you can maintain your health insurance without jeopardizing your MaineCare eligibility. However, if your child is part of the Katie Beckett Program, it is possible that your premium may increase if you qualify for PHIP.

-

How does the premium get paid?

Payments for the PHIP benefit are made directly to you, the policyholder, on a monthly basis. This means you will receive reimbursement for the premiums you pay for your private health insurance.

-

Can I have MaineCare and private health insurance at the same time?

Yes, it is possible to have both MaineCare and private health insurance simultaneously. The PHIP benefit is specifically designed for individuals who qualify for MaineCare while also maintaining private health insurance coverage.

-

How do I find out if the PHIP benefit can pay my insurance premium?

To determine your eligibility for the PHIP benefit, you will need to provide several pieces of information, including:

- Your completed Employer and Insurance Information form.

- Proof of your premium costs, such as a pay stub or current bill.

- Insurance rate breakdowns, including costs for different coverage levels.

- Details about your annual open enrollment period.

- Your individual deductible amount from your benefit summary.

- A copy of your medical and pharmacy insurance card.

- A completed W-9 form.

- A completed Direct Deposit Form.

- A voided check or bank letter with your account details.

-

How do I complete the PHIP application?

Completing the PHIP application involves several steps:

- Employer and Insurance Information Form: Fill in all requested details, including your premium amount and the frequency of deductions.

- W-9 Form: The policyholder must complete this form with their personal information.

- Direct Deposit Form: Ensure that the policyholder’s name matches the bank account information provided.

- MaineCare Participants Form: List all family members covered by the private health insurance.

Once completed, submit your application via mail, email, or fax.

-

What information is needed for the Employer and Insurance Information Form?

This form requires details such as your name, Social Security number, employer information, and the specifics of your health insurance plan. Make sure to indicate how much is deducted from your paycheck and the frequency of these deductions. It is also essential to include the dates for your open enrollment period.

-

What is the role of the W-9 Form in the application process?

The W-9 Form must be completed by the policyholder to facilitate the reimbursement process. This form collects basic information such as the policyholder's name, address, and Social Security number. It is important to note that this form is not used for tax reporting but is essential for the accounting department to issue checks.

-

What happens if I have questions during the application process?

If you encounter any questions or need assistance while completing your application, you can reach out to the PHIP office. They are available to provide guidance and clarify any uncertainties you may have regarding the application or eligibility process.

File Attributes

| Fact Name | Details |

|---|---|

| Program Overview | The Private Health Insurance Premium (PHIP) Program assists eligible MaineCare members by paying for their private health insurance premiums. |

| Eligibility Requirements | Applicants must already have private health insurance or be able to obtain it. MaineCare members with private insurance qualify for PHIP. |

| Payment Structure | PHIP pays the policyholder directly on a monthly basis for their health insurance premiums. |

| Impact on MaineCare | Receiving PHIP benefits will not affect an individual's eligibility for MaineCare. |

| Application Process | To apply, individuals must submit several documents, including proof of premium costs and completed forms like the W-9 and Direct Deposit Form. |

| Contact Information | For questions or assistance, individuals can reach the Benefits Administrator at 1-800-977-6740 or fax at (207) 287-9385. |

| Governing Law | The PHIP Program operates under the regulations set forth by the Maine Department of Health and Human Services and MaineCare guidelines. |

Documents used along the form

The Private Health Insurance Premium (PHIP) Program in Maine requires several forms and documents to ensure eligibility and facilitate the payment of private health insurance premiums. Below is a list of documents commonly associated with the PHIP Program. Each document plays a crucial role in the application process, providing necessary information to verify eligibility and streamline benefits.

- Employer and Insurance Information Form: This form collects details about the policyholder's employer and the specific health insurance plan. It includes information about premium costs and the frequency of deductions from paychecks.

- Boat Bill of Sale: For those involved in the sale or purchase of a boat, it is essential to have a Templates and Guide to ensure all necessary details are covered for legal compliance and smooth ownership transfer.

- Proof of Premium Costs: A current pay stub or bill that shows the amount paid for health insurance premiums. This document is essential for determining the reimbursement amount.

- Insurance Rate Breakdown: This document outlines the costs associated with different coverage options, such as single, employee/spouse, employee/child, and family plans. It is typically provided during the open enrollment period.

- MaineCare Participants Form: This form lists the names, relationships, and MaineCare ID numbers of all individuals covered by the private health insurance policy. It helps identify who benefits from the insurance.

- W-9 Form: Completed by the policyholder, this form provides necessary tax information for reimbursement purposes. It includes the policyholder's name, address, and social security number.

- Direct Deposit Form: This form authorizes the PHIP Program to deposit reimbursement payments directly into the policyholder's bank account. It requires the policyholder's bank account information.

- Medical and Pharmacy Insurance Card: A copy of both the front and back of the insurance card is required to verify coverage details and ensure proper processing of claims.

- Voided Check or Bank Letter: This document provides the necessary banking information for direct deposit. It must include the account holder's name, account number, and routing number.

- Open Enrollment Dates: Information regarding the annual open enrollment period is needed to track changes in premium costs and coverage options.

Each of these documents is vital for the successful application and ongoing management of the PHIP Program. Ensuring that all required forms are completed accurately will facilitate a smoother process for receiving benefits.

Misconceptions

- Misconception 1: PHIP is for individuals without health insurance.

- Misconception 2: Receiving PHIP benefits will affect my MaineCare eligibility.

- Misconception 3: The PHIP Program will find health insurance for me.

- Misconception 4: I can apply for PHIP benefits retroactively.

This is not true. The PHIP Program is specifically designed for MaineCare members who already have private health insurance or can obtain it. It does not provide health insurance; rather, it helps cover the costs of existing premiums.

This misconception is common. However, having PHIP pay for your private health insurance premium will not cause you to lose your MaineCare benefits. You can maintain both simultaneously.

Many believe that PHIP assists in finding health insurance. In reality, MaineCare does not provide this service. Individuals must already have health insurance or be able to secure it independently.

This is incorrect. The PHIP Program does not qualify individuals for benefits for prior months. Applications must be submitted for the current month or future months only.

Document Preview

|

Maine Department of Health and Human Services |

|

Janet T. Mills |

Office of MaineCare Services |

|

Private Health Insurance Premium (PHIP) |

||

Governor |

||

11 State House Station |

||

|

||

|

Augusta, Maine |

|

Jeanne M. Lambrew, Ph.D. |

Toll Free: (800) |

|

Commissioner |

TTY: Dial 711 (Maine Relay) |

Private Health Insurance Premium Benefit

What is the MaineCare PHIP Benefit?

PHIP pays private health insurance premiums for MaineCare members who qualify. You must already have health insurance, or you must be able to get it. You may have health insurance through your job, or you may have an individual policy through an insurance company. MaineCare will not find health insurance for you.

How will the PHIP benefit help me?

MaineCare will pay part or all of the monthly cost of your health insurance plan. Having the

PHIP pay your private health insurance premium will not make you lose MaineCare.

If your child is enrolled in the Katie Beckett Program and you become eligible for the PHIP Program, your Katie Beckett premium may increase.

How does the premium get paid?

The PHIP Benefit Program will pay you (the policyholder) every month.

Can I have MaineCare and private health insurance at the same time?

Yes, even if you have private health insurance, you can qualify for MaineCare. PHIP is only for people who have MaineCare and private health insurance.

How do I find out if the PHIP benefit can pay my insurance premium?

We will need the following information to see if you are eligible for PHIP:

•Employer and Insurance Information form, enclosed with this application.

•Proof of the cost of your premium on a current pay stub or a current bill.

•The rates for the insurance to include the breakdown of cost for Employee,

Employee/Spouse, Employee/Child, and Family. This should be given to you during the open enrollment period and should be attainable through your employer’s Human

Resources Department.

•The annual open enrollment period dates and the effective date of the benefit period.

•The section of your benefit summary that includes your individual deductible amount.

•A copy of your medical and pharmacy insurance card, front and back.

•

•A completed Direct Deposit Form.

•A voided check or letter from your bank on their letterhead providing their routing number, your name, address, account number and must indicate if it is a savings or checking account. We do not accept deposit slips or a starter check.

How do I complete the PHIP application?

Directions for filling out the PHIP application:

•Employer and Insurance Information Form: Please fill in all requested information on the form. Be sure you list the amount you pay for your policy and, if it is an employer plan, how often money is deducted from your paycheck. Please also note when open enrollment is so we know when to expect your costs to change. *We do not cover dental.

•

date. This form is not used for tax reporting services. Our Accounting department needs it in order to send you checks.

•Direct Deposit Form: The policyholder must be on the checking or savings account. If you have a savings account that you want the check to go into, attach a letter from the bank with the account number, routing number, and name of account holder.

•MaineCare Participants Form: Please list the names, relationship to the policy holder; and MaineCare ID number and date of birth for each person. This form tells us who in the family is covered or will be covered by the private health insurance.

Please send the information to me by mail, email, or fax. We do not qualify you for prior months. If you have questions, please feel free to contact our office.

Sincerely,

Benefits Administrator

|

|

EMPLOYER AND INSURANCE INFORMATION |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Employee Social |

||||

|

Employee Name: |

Security Number: |

||||||

|

|

|

|

|

|

|

|

|

|

Employee Address: |

Telephone Number: |

||||||

|

|

|

|

|

|

|

|

|

|

Employer Name: |

Contact Person: |

||||||

|

|

|

|

|

|

|

|

|

|

Employer Address: |

Telephone Number: |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date of open enrollment: ______ |

|

|

|

|

|

||

|

Medical Ins. Carrier Name: |

|

Medical Ins. Carrier Address: |

|||||

|

|

|

|

|

|

|

|

|

PLEASE ONLY SHOW HOW MUCH IS ACTUALLY BEING DEDUCTED FROM PAYCHECK

Single - Medical Employee w/Chrn - Medical Employee & Spouse

-Medical Family - Medical

Employee |

|

How Often Deducted |

|

Coverage (Please X |

Cost |

|

|

|

|

|

|

|

covered services) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Weekly ↓ |

|

HMO, PPO |

|

|

Please circle 50 or 52 times/yr. |

|

Maj. Med/Comp. Plan |

|

|

|

Prescriptions |

|

|

|

|

||

|

|

Please circle 24 or 26 times/yr. |

|

Prescriptions Card |

|

|

|

||

|

|

Monthly |

|

Vision – Exam 1yrly |

|

|

|

||

|

|

|

|

Flexible Spending Acct |

|

|

Yearly |

|

HSA and/or HRA Acct |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

Medical Deductibles: |

|

|

|

|

Single: __________________ |

|

|

|

|

Family: |

|

|

|

|

|

|

|

|

|

Enrolled: Medical |

Y______ |

N______ |

|

|

|

|

Group # |

|

|

Certificate # _____________________ |

__________________________ |

|

|

|

|

|

|

|

MaineCare Member Information

Policyholder: _______________________________________________________

MaineCare ID# or DOB: ______________________________________________

Email Address: _____________________________________________________

MaineCare Member: _________________________________________________

MaineCare ID# or DOB: ______________________________________________

Relationship to Policyholder: __________________________________________

MaineCare Member: _________________________________________________

MaineCare ID# or DOB: ______________________________________________

Relationship to Policyholder: __________________________________________

MaineCare Member: _________________________________________________

MaineCare ID# or DOB: ______________________________________________

Relationship to Policyholder: __________________________________________

MaineCare Member: _________________________________________________

MaineCare ID# or DOB: ______________________________________________

Relationship to Policyholder: __________________________________________

MaineCare Member: _________________________________________________

MaineCare ID# or DOB: ______________________________________________

Relationship to Policyholder: __________________________________________

MaineCare Member: _________________________________________________

MaineCare ID# or DOB: ______________________________________________

Relationship to Policyholder: __________________________________________

MaineCare Member: _________________________________________________

MaineCare ID# or DOB: ______________________________________________

Relationship to Policyholder: __________________________________________