Legal Operating Agreement Template for Maine

The Maine Operating Agreement form is a vital document for any limited liability company (LLC) operating in the state of Maine. This form outlines the internal workings of the LLC, detailing how the business will be managed and how decisions will be made. It typically includes important elements such as the roles and responsibilities of members, how profits and losses will be distributed, and the procedures for adding or removing members. Additionally, the agreement can address how disputes will be resolved and what happens if the company needs to be dissolved. By providing a clear framework, the Operating Agreement helps ensure that all members are on the same page, reducing the likelihood of misunderstandings and conflicts down the road. Whether you're starting a new business or looking to formalize an existing one, having a well-crafted Operating Agreement is essential for protecting your interests and promoting smooth operations.

Dos and Don'ts

When filling out the Maine Operating Agreement form, it's important to approach the process with care and attention to detail. Here are some helpful tips to consider:

- Do read the instructions carefully before starting. Understanding what is required can save time and prevent mistakes.

- Do provide accurate information. Double-check names, addresses, and other details to ensure they are correct.

- Do consult with a professional if you have questions. Seeking guidance can help clarify complex issues.

- Do keep a copy of the completed form for your records. This can be useful for future reference.

- Don't rush through the form. Taking your time can help you avoid errors that may delay processing.

- Don't leave any required fields blank. Incomplete forms may be rejected or returned for correction.

Key takeaways

When filling out and using the Maine Operating Agreement form, consider the following key takeaways:

- Ensure that all members of the LLC are clearly identified, including their names and addresses.

- Define the purpose of the LLC explicitly to avoid any ambiguity regarding its operations.

- Outline the management structure, specifying whether the LLC will be member-managed or manager-managed.

- Include provisions for profit and loss distribution among members, detailing how earnings will be allocated.

- Establish procedures for adding or removing members to maintain clarity in membership changes.

- Address dispute resolution methods to handle potential conflicts between members effectively.

- Review the document regularly and update it as necessary to reflect any changes in the business or membership.

Instructions on Filling in Maine Operating Agreement

Filling out the Maine Operating Agreement form is an important step in establishing your business. After completing the form, you will have a clear understanding of your business structure and the roles of each member involved. Follow these steps to ensure accuracy and completeness.

- Begin with the title of the agreement at the top of the form.

- Enter the name of your business exactly as registered with the state.

- Provide the principal office address. This should be the main location where your business operates.

- List the names and addresses of all members involved in the business.

- Specify the purpose of your business. Be clear and concise about what your business will do.

- Outline the management structure. Indicate whether the business will be managed by members or designated managers.

- Detail the capital contributions from each member. Include the amount and type of contribution.

- Describe the distribution of profits and losses among members. Be specific about how these will be allocated.

- Include provisions for adding new members or handling the departure of existing members.

- Review the agreement for accuracy. Ensure all members have agreed to the terms outlined.

- Have all members sign and date the agreement. Make sure each member receives a copy for their records.

Other Maine Forms

Selling a Car in Maine - This document is particularly important for private sales outside of dealerships.

When completing a boat transaction in New York, it's important to utilize the New York Boat Bill of Sale, which acts as a receipt for the sale of a boat or watercraft. This essential document includes the buyer and seller's information, a description of the boat, and the sale price, helping to confirm ownership. For those looking for assistance in creating this document, refer to Templates and Guide to streamline the process.

Maine Car Sales Tax - A Bill of Sale is a legal document that transfers ownership of personal property from one person to another.

Standard Rental Application Pdf - List any intentions for longer lease periods if applicable.

Learn More on This Form

-

What is a Maine Operating Agreement?

A Maine Operating Agreement is a legal document that outlines the management structure and operational procedures of a Limited Liability Company (LLC) in Maine. This agreement serves as a guide for the members of the LLC, detailing their rights, responsibilities, and how decisions will be made. It is not required by law in Maine, but it is highly recommended to prevent disputes and ensure clarity among members.

-

Who should create an Operating Agreement?

All members of an LLC in Maine should consider creating an Operating Agreement. Whether you are a single-member LLC or have multiple members, this document helps establish a clear understanding of how the business will operate. It is especially important for multi-member LLCs, as it can help prevent misunderstandings and conflicts among members.

-

What should be included in a Maine Operating Agreement?

A comprehensive Maine Operating Agreement typically includes:

- The name and purpose of the LLC

- The names of the members and their ownership percentages

- Details on how profits and losses will be distributed

- Management structure and decision-making processes

- Procedures for adding or removing members

- Guidelines for resolving disputes

Including these elements helps ensure that all members are on the same page and can refer back to the agreement when needed.

-

Is the Operating Agreement filed with the state?

No, the Operating Agreement is not filed with the state of Maine. It is an internal document that remains with the LLC. However, it is crucial for members to keep a copy of the agreement in a safe place, as it may be needed for reference in the future, especially in legal or financial matters.

PDF Form Information

| Fact Name | Details |

|---|---|

| Purpose | The Maine Operating Agreement outlines the management structure and operational guidelines for a limited liability company (LLC). |

| Governing Law | This form is governed by Title 31, Chapter 157 of the Maine Revised Statutes. |

| Members | It specifies the rights and responsibilities of the LLC members, including their voting power and profit distribution. |

| Flexibility | The agreement allows for customization to suit the specific needs and agreements of the members. |

| Legal Requirement | While not required by law, having an Operating Agreement is highly recommended for LLCs in Maine. |

| Dispute Resolution | It often includes provisions for resolving disputes among members, which can help avoid costly litigation. |

| Amendments | Members can amend the Operating Agreement as needed, following the procedures outlined within the document. |

| Tax Treatment | The agreement can define how the LLC will be taxed, whether as a partnership or corporation, impacting members' tax obligations. |

| Duration | The Operating Agreement can specify the duration of the LLC, whether it is perpetual or for a defined term. |

Documents used along the form

When forming a limited liability company (LLC) in Maine, the Operating Agreement is a crucial document that outlines the management structure and operational procedures of the business. However, several other forms and documents often accompany the Operating Agreement to ensure compliance and proper functioning of the LLC. Below are some of these essential documents.

- Articles of Organization: This document is filed with the state to officially create the LLC. It includes basic information such as the company name, address, and the names of the members or managers. Filing this document is a key step in the formation process.

- Member Consent: This document is used to obtain the agreement of all members regarding important decisions or actions taken by the LLC. It serves as a record of consent for matters that require unanimous approval, ensuring transparency and accountability among members.

- Operating Procedures: While the Operating Agreement details the overall management structure, the Operating Procedures document outlines specific day-to-day operations and guidelines for running the business. This can include roles and responsibilities, decision-making processes, and protocols for handling disputes.

- Durable Power of Attorney: To ensure your legal preferences are respected, consider the comprehensive Durable Power of Attorney documentation that allows someone to make decisions on your behalf when necessary.

- Tax Identification Number (TIN) Application: An LLC must obtain a TIN from the IRS for tax purposes. This document is essential for opening a business bank account, hiring employees, and filing taxes. The application process is straightforward and can usually be completed online.

These documents, along with the Maine Operating Agreement, help establish a solid foundation for the LLC. Properly preparing and maintaining these forms can lead to smoother operations and help prevent potential disputes among members in the future.

Misconceptions

When it comes to the Maine Operating Agreement form, several misconceptions can lead to confusion. Understanding these common misunderstandings is essential for anyone involved in business formation or management in the state. Here are four prevalent misconceptions:

-

All businesses in Maine must use the Operating Agreement form.

This is not true. While an Operating Agreement is highly recommended for LLCs in Maine, it is not legally required. Sole proprietorships and partnerships do not need this document. However, having an Operating Agreement can help clarify roles and responsibilities within an LLC.

-

The Operating Agreement is the same as the Articles of Organization.

This misconception can lead to significant confusion. The Articles of Organization are filed with the state to officially create the LLC, while the Operating Agreement outlines how the LLC will operate. They serve different purposes and are both important in their own right.

-

Once created, the Operating Agreement cannot be changed.

Many believe that an Operating Agreement is set in stone, but this is incorrect. Members of the LLC can amend the Operating Agreement as needed, provided they follow the procedures outlined within the document itself. Flexibility is a key feature of this agreement.

-

The Operating Agreement is only for large businesses.

This is a common misconception. In reality, Operating Agreements are beneficial for businesses of all sizes, including small LLCs. They help establish clear guidelines and protect the interests of all members, regardless of the business's scale.

By addressing these misconceptions, individuals can make more informed decisions about their business structures and ensure they are adequately prepared for the responsibilities that come with managing an LLC in Maine.

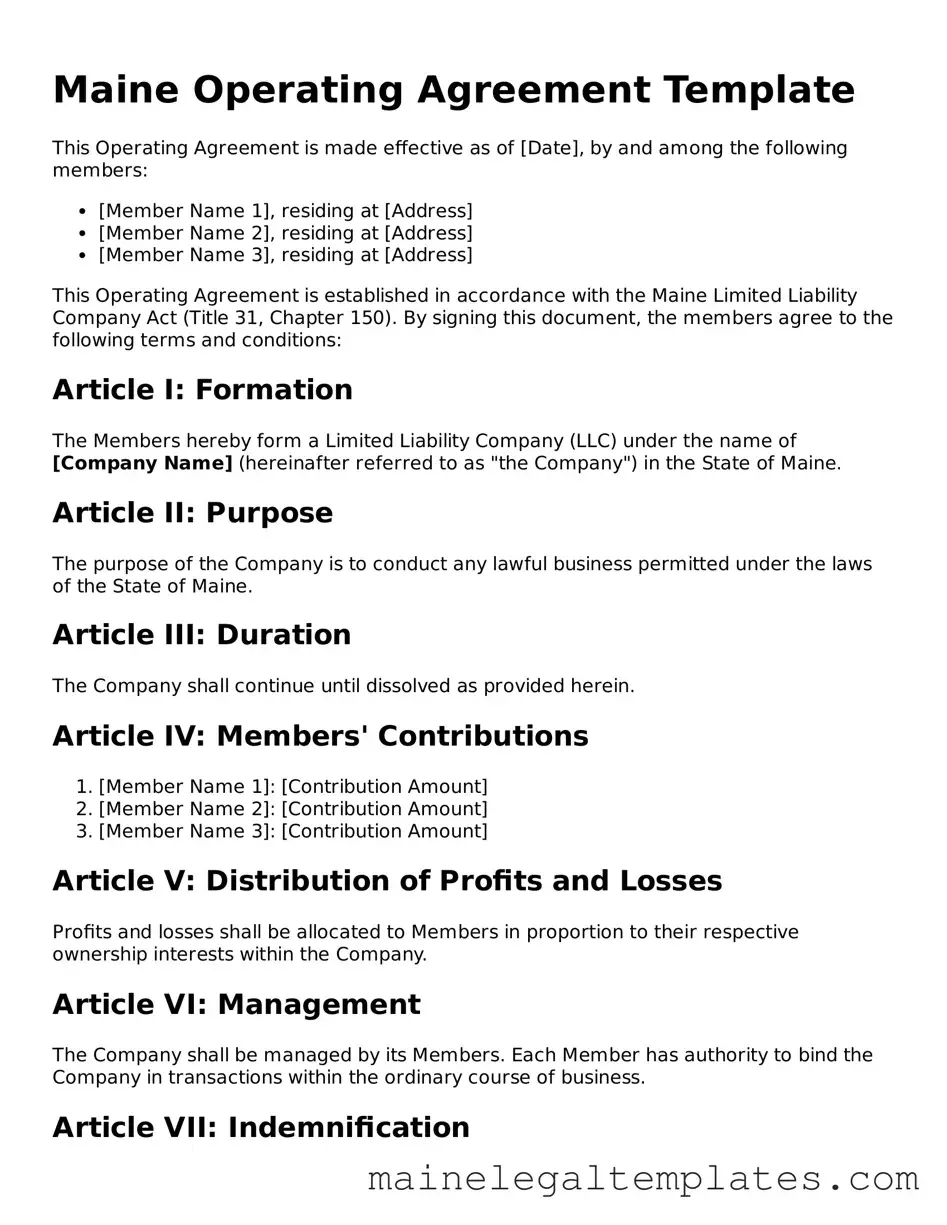

Document Preview

Maine Operating Agreement Template

This Operating Agreement is made effective as of [Date], by and among the following members:

- [Member Name 1], residing at [Address]

- [Member Name 2], residing at [Address]

- [Member Name 3], residing at [Address]

This Operating Agreement is established in accordance with the Maine Limited Liability Company Act (Title 31, Chapter 150). By signing this document, the members agree to the following terms and conditions:

Article I: Formation

The Members hereby form a Limited Liability Company (LLC) under the name of [Company Name] (hereinafter referred to as "the Company") in the State of Maine.

Article II: Purpose

The purpose of the Company is to conduct any lawful business permitted under the laws of the State of Maine.

Article III: Duration

The Company shall continue until dissolved as provided herein.

Article IV: Members' Contributions

- [Member Name 1]: [Contribution Amount]

- [Member Name 2]: [Contribution Amount]

- [Member Name 3]: [Contribution Amount]

Article V: Distribution of Profits and Losses

Profits and losses shall be allocated to Members in proportion to their respective ownership interests within the Company.

Article VI: Management

The Company shall be managed by its Members. Each Member has authority to bind the Company in transactions within the ordinary course of business.

Article VII: Indemnification

The Company shall indemnify its Members to the fullest extent permitted by Maine law against any losses, costs, and expenses incurred in connection with the Company.

Article VIII: Amendments

This Operating Agreement may only be amended by a written agreement signed by all Members.

Article IX: Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the State of Maine.

IN WITNESS WHEREOF, the Members have executed this Operating Agreement as of the date first above written.

[Member Name 1] ____________________ Date: __________

[Member Name 2] ____________________ Date: __________

[Member Name 3] ____________________ Date: __________