Get Maine Tax Form in PDF

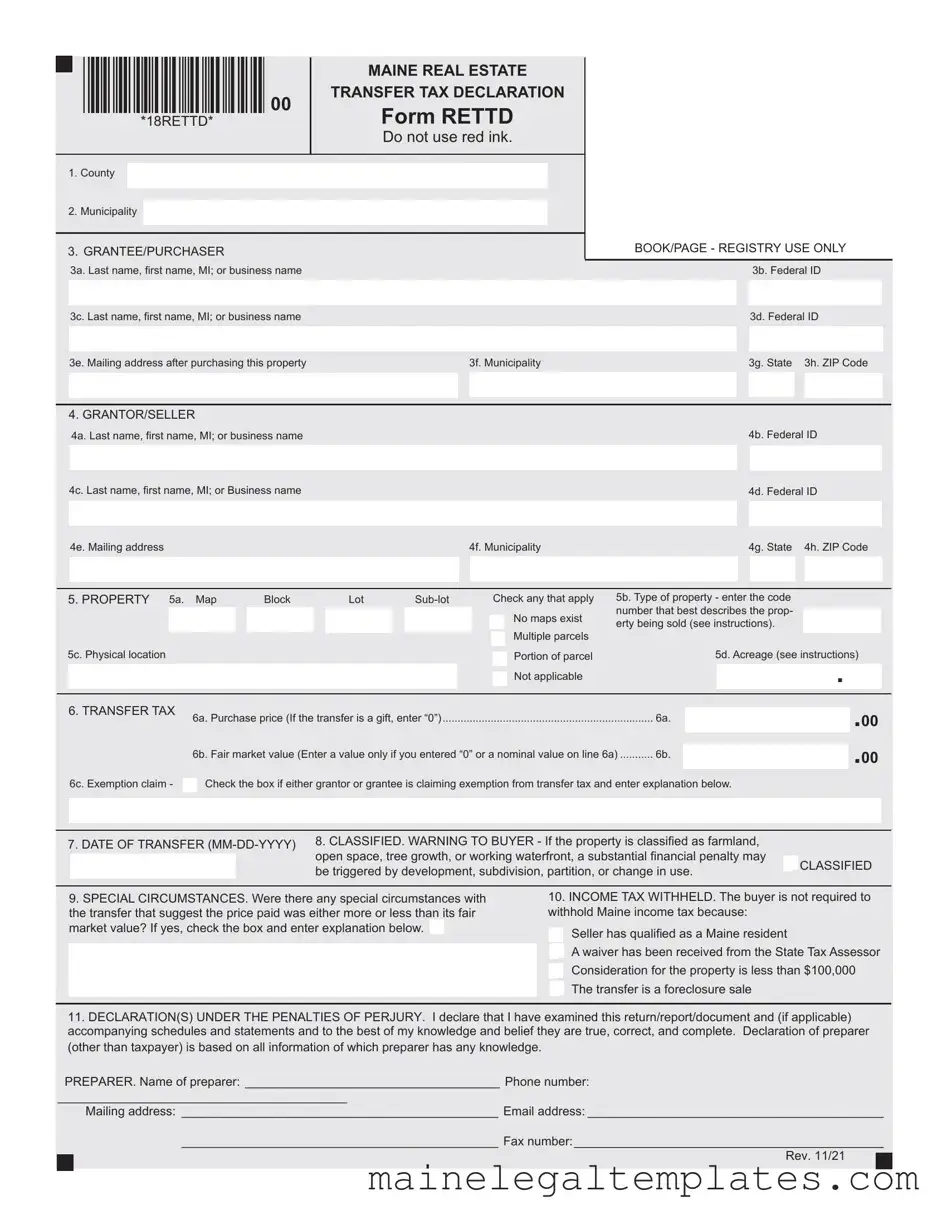

The Maine Real Estate Transfer Tax Declaration, commonly referred to as Form RETTD, plays a crucial role in the process of property transactions within the state. This form must be submitted to the county Registry of Deeds when a deed is recorded, ensuring that the transfer tax is appropriately assessed and collected based on the property's value. The form requires detailed information from both the buyer and seller, including names, addresses, and federal identification numbers. It also necessitates the description of the property being transferred, including its location and type. A key component of the form is the declaration of the purchase price and fair market value, which are essential for calculating the transfer tax, set at $2.20 for every $500 of value. Additionally, the form addresses exemptions from the transfer tax and includes a warning regarding potential penalties for properties classified under certain use programs, such as farmland or working waterfront. The completion of this form is not only a legal requirement but also a step toward transparency and compliance in real estate transactions in Maine.

Dos and Don'ts

When filling out the Maine Tax form, there are several important dos and don'ts to keep in mind. Following these guidelines can help ensure that your submission is accurate and complete.

- Do use black or blue ink only. Avoid using red ink, as it can cause issues with processing.

- Do provide accurate names and addresses for both the buyer and seller. Double-check for spelling errors.

- Do enter the correct property type code from the provided list. This helps classify the property appropriately.

- Do include the date of transfer in the correct format (MM-DD-YYYY) to avoid confusion.

- Don't leave any required fields blank. Each section of the form needs to be filled out completely.

- Don't use a Social Security number for business entities. Instead, use the federal ID number.

- Don't forget to check for any special circumstances that may affect the transfer price. Provide an explanation if applicable.

Key takeaways

1. The Maine Real Estate Transfer Tax Declaration Form (RETTD) must be submitted to the county Registry of Deeds when recording a deed.

2. The transfer tax is calculated at $2.20 for every $500 of the property's value, split evenly between the buyer and seller.

3. If the property is located in multiple municipalities or involves more than two buyers or sellers, a Supplemental Form is required.

4. Accurate completion of the form is crucial. For example, when entering names, always list the last name first, followed by the first name and middle initial if applicable.

5. If the property is classified under certain categories, such as farmland or open space, be aware that significant financial penalties may apply if there is a change in use.

6. When indicating the purchase price, enter “0” if the transfer is a gift. If a nominal value is reported, provide the fair market value on the appropriate line.

7. Ensure to check the box for any exemptions from the transfer tax and provide a detailed explanation if applicable.

8. The date of transfer must reflect when the ownership is officially delivered, which may differ from the recording date.

9. If there are special circumstances affecting the sale price, indicate this on the form and provide an explanation to clarify the situation.

Instructions on Filling in Maine Tax

Filling out the Maine Real Estate Transfer Tax Declaration form is an important step in the process of transferring property. This form must be completed accurately and submitted to the county Registry of Deeds when the deed is recorded. Below are the steps to guide you through the process of filling out this form.

- County: Write the name of the county where the property is located. If the property spans multiple counties, separate forms must be completed.

- Municipality: Indicate the name of the municipality where the property is situated. Again, if the property is in more than one municipality, a Supplemental Form is required.

- Grantee/Purchaser:

- 3a: Enter the last name, first name, and middle initial (or business name) of the purchaser.

- 3b: Provide the federal ID number. If it’s a business, use the business ID; otherwise, enter all zeros if applicable.

- 3c: If there is a second purchaser, enter their name similarly as in 3a.

- 3d: Enter the federal ID number for the second purchaser, if applicable.

- 3e: Provide the mailing address for the buyer after the purchase.

- 3f: Indicate the municipality of the buyer.

- 3g: Write the state of the buyer.

- 3h: Enter the ZIP code for the buyer's mailing address.

- Grantor/Seller:

- 4a: Enter the last name, first name, and middle initial (or business name) of the seller.

- 4b: Provide the federal ID number for the seller.

- 4c: If there is a second seller, enter their name similarly as in 4a.

- 4d: Enter the federal ID number for the second seller, if applicable.

- 4e: Provide the mailing address for the seller after the sale.

- 4f: Indicate the municipality of the seller.

- 4g: Write the state of the seller.

- 4h: Enter the ZIP code for the seller's mailing address.

- Property:

- 5a: Enter the map-block-lot-sub lot number for the property.

- 5b: Choose the property type code that best describes the property being sold.

- 5c: If applicable, provide the physical location of the property.

- 5d: Enter the acreage of the property. If unsure, provide an estimate.

- Transfer Tax:

- 6a: Enter the purchase price. If it’s a gift, write “0”.

- 6b: If you entered “0” on line 6a, provide the fair market value of the property.

- 6c: If claiming an exemption from the transfer tax, check the box and provide an explanation.

- Date of Transfer: Enter the date when the property transfer takes place.

- Classified: Check the box if the property is classified under current use programs.

- Special Circumstances: If there were any unique circumstances affecting the sale price, check the box and explain.

- Income Tax Withheld: Indicate the reason why the buyer is not required to withhold Maine income tax.

- Declaration: Provide the name, mailing address, phone number, and email of the preparer if it differs from the parties involved in the transaction.

Find Popular Forms

How to Change Your Name in Maine - Petitioners can typically expect to receive a court date following submission.

Proof of Residency Maine - It is important for minors to have a parent or guardian accompany them for identity verification.

For those looking to engage in a private sale of a dirt bike in New York, it is vital to utilize the New York Dirt Bike Bill of Sale form, which not only documents the ownership transfer but also ensures that both the buyer and seller are protected in the transaction. To facilitate this process and avoid any confusion, you may want to refer to additional resources available at Templates and Guide, which provide valuable insights into completing this form correctly.

Registering a Salvage Title in Texas - Ownership disputes can be minimized with detailed form records.

Learn More on This Form

-

What is the purpose of the Maine Real Estate Transfer Tax Declaration Form (RETTD)?

The Maine Real Estate Transfer Tax Declaration Form (RETTD) is required to be filed with the county Registry of Deeds when a deed is recorded. This form helps the Registry collect a tax based on the value of the property being transferred. The tax rate is set at $2.20 for every $500 of value, split evenly between the buyer and the seller.

-

Who is responsible for completing the form?

Both the buyer (grantee) and the seller (grantor) are responsible for providing accurate information on the form. If there are more than two parties involved in the transaction, a Supplemental Form must be completed. It is crucial that all parties ensure the accuracy of the details provided to avoid potential legal issues.

-

What information is required on the form?

The form requires various details, including:

- County and municipality where the property is located.

- Names and federal ID numbers of both the grantee and grantor.

- Property details, including map-block-lot numbers and property type codes.

- Purchase price or fair market value, along with any exemption claims.

- Date of transfer and any special circumstances related to the transaction.

-

What should I do if the property is classified under a current use program?

If the property falls under a current use program, such as farmland or open space, you must check the appropriate box on the form. Be aware that developing or changing the use of the property may trigger significant financial penalties. It’s important to fully understand these implications before proceeding.

-

What happens if I fail to file the form?

Failure to file the RETTD can result in penalties and complications with the property transfer. The Registry of Deeds may refuse to record the deed without the completed form. Additionally, you may face financial repercussions related to unpaid transfer taxes. To avoid these issues, ensure that the form is completed accurately and submitted in a timely manner.

File Attributes

| Fact Name | Details |

|---|---|

| Form Title | Maine Real Estate Transfer Tax Declaration (Form RETTD) |

| Filing Requirement | This form must be filed with the county Registry of Deeds when the accompanying deed is recorded. |

| Transfer Tax Rate | The tax is $2.20 for each $500 of value, imposed equally on both the purchaser and seller. |

| Exemption Claims | Grantors or grantees may claim exemptions from transfer tax under 36 M.R.S. § 4641-C. |

| Supplemental Forms | A Supplemental Form is required if the property is in multiple municipalities or if there are more than two sellers or buyers. |

| Date of Transfer | The date of transfer is when ownership or title is delivered to the purchaser, which may differ from the recording date. |

| Income Tax Withholding | Nonresident sellers may be subject to real estate withholding under 36 M.R.S. § 5250-A. |

Documents used along the form

When dealing with real estate transactions in Maine, several forms and documents are commonly used alongside the Maine Tax form. These documents help ensure that all aspects of the property transfer are properly documented and compliant with state regulations.

- Real Estate Purchase and Sale Agreement: This document outlines the terms and conditions of the sale between the buyer and seller. It includes details such as the purchase price, property description, and any contingencies that must be met before the sale is finalized.

- Deed: The deed is the legal document that transfers ownership of the property from the seller to the buyer. It must be signed and notarized to be valid and is typically recorded at the county Registry of Deeds.

- Property Disclosure Statement: This statement provides buyers with information about the condition of the property. Sellers are required to disclose any known issues or defects, helping buyers make informed decisions.

- Supplemental Form: If there are multiple buyers or sellers, or if the property is located in more than one municipality, a Supplemental Form must be completed. This ensures that all parties and properties are accurately represented in the transaction.

- Motorcycle Bill of Sale: Essential for transferring motorcycle ownership in New Jersey, the Motorcycle Bill of Sale form certifies the sale and includes important details about the motorcycle and transaction.

- Title Insurance Policy: This policy protects the buyer against any claims or disputes regarding the property’s title. It ensures that the buyer has clear ownership and can help cover legal costs if issues arise.

- Closing Statement: Also known as a HUD-1 Settlement Statement, this document details all financial transactions related to the sale. It includes costs, fees, and the final amounts owed by both the buyer and seller at closing.

These documents play crucial roles in the real estate transaction process. They help protect the interests of all parties involved and ensure that the transfer of property is handled smoothly and legally.

Misconceptions

Understanding the Maine Tax form can be challenging. Here are six common misconceptions that people often have:

- Misconception 1: The Maine Tax form is only for residential properties.

- Misconception 2: You can use red ink when filling out the form.

- Misconception 3: Only the seller is responsible for the transfer tax.

- Misconception 4: You don't need to report a gift on the form.

- Misconception 5: If the property is classified as farmland, there are no additional considerations.

- Misconception 6: You can submit the form after the deed is recorded.

This is not true. The form applies to all types of properties, including commercial, industrial, and vacant land. It is essential for anyone transferring real estate in Maine, regardless of the property type.

Actually, you should avoid using red ink. The form specifies that you must use black or blue ink to ensure clarity and proper processing.

This is a common misunderstanding. The transfer tax is shared equally between the buyer and the seller, each paying half of the total tax based on the property's value.

While gifts may not incur a transfer tax, you still need to report them on the form. Enter “0” for the purchase price if the transfer is a gift.

This is misleading. If the property is classified as farmland or under other special classifications, transferring it may trigger financial penalties if its use changes. Always check the classification before proceeding.

That’s incorrect. The Real Estate Transfer Tax Declaration must be filed with the county Registry of Deeds at the same time as the deed is recorded. Delaying this can lead to complications.

Document Preview

|

|

|

MAINE REAL ESTATE |

|

|

|

|

|

|

00 |

TRANSFER TAX DECLARATION |

|

|

Form RETTD |

|

|

*18RETTD* |

|

|

|

|

|

|

|

|

|

Do not use red ink. |

|

|

|

|

1.County

2.Municipality

3.GRANTEE/PURCHASER

3a. Last name, fi rst name, MI; or business name

3c. Last name, fi rst name, MI; or business name

3e. Mailing address after purchasing this property |

3f. Municipality |

|

|

|

|

BOOK/PAGE - REGISTRY USE ONLY

3b. Federal ID

3d. Federal ID

3g. State 3h. ZIP Code

4. GRANTOR/SELLER

|

4a. Last name, fi rst name, MI; or business name |

|

|

4b. |

Federal ID |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4c. Last name, fi rst name, MI; or Business name |

|

|

|

|

|

|

|

|

|

|

|

4d. |

Federal ID |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4e. Mailing address |

4f. Municipality |

4g. |

State 4h. ZIP Code |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5. PROPERTY 5a. Map |

|

Block |

|

Lot |

|

Check any that apply |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

No maps exist |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Multiple parcels |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

5c. Physical location |

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Portion of parcel |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Not applicable |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5b. Type of property - enter the code number that best describes the prop- erty being sold (see instructions).

5d. Acreage (see instructions)

.

6. TRANSFER TAX |

6a. |

Purchase price (If the transfer is a gift, enter “0”) |

6a. |

|

|

.00 |

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

.00 |

||

|

6b. |

Fair market value (Enter a value only if you entered “0” or a nominal value on line 6a) |

6b. |

|

|

||

|

|

|

|

|

|

|

|

6c. Exemption claim -  Check the box if either grantor or grantee is claiming exemption from transfer tax and enter explanation below.

Check the box if either grantor or grantee is claiming exemption from transfer tax and enter explanation below.

7. DATE OF TRANSFER |

8. CLASSIFIED. WARNING TO BUYER - If the property is classifi ed as farmland, |

|

|

||

open space, tree growth, or working waterfront, a substantial fi nancial penalty may |

|

|

|||

|

|

|

|

CLASSIFIED |

|

|

|

|

|

||

|

|

|

|

||

|

|

|

|

||

|

|

|

be triggered by development, subdivision, partition, or change in use. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9.SPECIAL CIRCUMSTANCES. Were there any special circumstances with

the transfer that suggest the price paid was either more or less than its fair market value? If yes, check the box and enter explanation below.

10.INCOME TAX WITHHELD. The buyer is not required to withhold Maine income tax because:

Seller has qualified as a Maine resident

Seller has qualified as a Maine resident

A waiver has been received from the State Tax Assessor

A waiver has been received from the State Tax Assessor

Consideration for the property is less than $100,000

Consideration for the property is less than $100,000  The transfer is a foreclosure sale

The transfer is a foreclosure sale

11.DECLARATION(S) UNDER THE PENALTIES OF PERJURY. I declare that I have examined this return/report/document and (if applicable) accompanying schedules and statements and to the best of my knowledge and belief they are true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

PREPARER. Name of preparer: _____________________________________ Phone number:

__________________________________________

Mailing address: ______________________________________________ Email address: ___________________________________________

______________________________________________ Fax number:_____________________________________________

Rev. 11/21

Real Estate Transfer Tax Declaration

Instructions

The Real Estate Transfer Tax Declaration (Form RETTD) must be fi led with the county Registry of Deeds when the accompanying deed is recorded. The Registry of Deeds will collect a tax based on the value of the transferred property. The tax is equals $2.20 for each $500 of value and is imposed half on the purchaser and half on the seller. If the transferred property is in more than one municipality or if there are more than two sellers or buyers, a Supplemental Form must be completed. For more information, visit www.maine.gov/ revenue/propertytax/transfertax/transfertax.htm or contact the Property Tax Division at

Line 1. County. Enter the name of the county where the property is lo- cated. If the property is in more than one county, complete separate Forms

RETTD.

Line 2. Municipality. Enter the name of the municipality where the prop- erty is located. If the transferred property is located in more than one mu- nicipality, complete a Supplemental Form.

Line 3. Grantee/Purchaser. a) & c): Enter one name on each available line, beginning with last name fi rst. If more than two purchasers, complete a Supplemental Form. b) & d): If a business entity is entered on a) or c), enter the entity’s federal ID number. Do not enter a social security number. If you do not have a federal ID number, or if the transfer is of unimproved land for less than $25,000 or land with improvements for less than $50,000, you may enter all 0s in this fi eld. e) through h): Enter the mailing address for the buyer after the purchase of this property.

Line 4. Grantor/Seller. a) & c): Enter one name on each available line, beginning with last name fi rst. If more than two sellers, complete a Supplemental Form. b) & d): If a business entity is entered on a) or c), enter the entity’s federal ID number. Do not enter a social security number If you do not have a federal ID number, or if the transfer is of unimproved land for less than $25,000 or land with improvements for less than $50,000, you may enter all 0s in this fi eld. e) through h): Enter the mailing address for the seller after the purchase of this property.

Line 5. Property. a): Enter the appropriate

don’t know the exact acreage, enter an estimate based on the available information. The acreage recital is for MRS purposes only and it does not constitute a guarantee to the buyer of the acreage being conveyed. EXCEPTION: If the transferred property is a gift, you do not need to complete lines b) and d).

Line 6. Transfer tax. a): Enter the actual sale price or “0” if the transfer

is a gift. b): If you entered 0 or a sale price that is considered nominal on line a), enter the fair market value of the property on this line. The fair market value is based on the estimated price a property will bring in the open market and under prevailing market conditions in a sale between a willing buyer and a willing seller and must reflect the value at the time of the transfer. c): If either party is claiming an exemption from the transfer tax, check this box and enter an explanation of the reason for the claim. See 36 M.R.S. §

Line 7. Date of transfer. Enter the date of the property transfer, which refl ects when the ownership or title to the real property is delivered to the purchaser. This date may not be the same as the recording date.

Line 8. Classified. Check the box if the property is enrolled in one of the current use programs. Current use programs are tree growth, farm and open space, and working waterfront.

Line 9. Special circumstances. If the sale of the property was either substantially more or less than the fair market value, check this box and enter an explanation of the circumstances.

Line 10. Income tax withheld. Nonresident sellers are subject to real estate withholding under 36 M.R.S. §

Line 11. Declaration(s) under penalty of perjury. Please provide the name, mailing address, phone number, and email address of the person or company preparing this form if diff erent from the parties of the transaction.

PROPERTY TYPE CODES

VACANT LAND |

|

COMMERCIAL |

|

INDUSTRIAL |

|

RESIDENTIAL |

|

MISC CODES |

|

Rural |

101 |

Mixed use |

301 |

Gas and oil |

401 |

Rural |

201 |

Government |

501 |

Urban |

102 |

5+ unit apt. |

303 |

Utility |

402 |

Urban |

202 |

Condominium |

502 |

Oceanfront |

103 |

Bank |

304 |

Gravel pit |

403 |

Oceanfront |

203 |

Timeshare unit |

503 |

Lake/pond front |

104 |

Restaurant |

305 |

Lumber/saw mill |

404 |

Lake/pond front |

204 |

Nonprofi t |

504 |

Stream/riverfront |

105 |

Medical |

306 |

Pulp/paper mill |

405 |

Stream/riverfront |

205 |

Mobile home park |

505 |

Agricultural |

106 |

Office |

307 |

Light manufacture |

406 |

Mobile home |

206 |

Airport |

506 |

Commercial zone 107 |

Retail |

308 |

Heavy manufacture |

407 |

207 |

Conservation |

507 |

||

Other |

120 |

Automotive |

309 |

Other |

420 |

Other |

220 |

Current use |

|

|

|

Marina |

310 |

|

|

|

|

classifi cation |

508 |

|

|

Warehouse |

311 |

|

|

|

|

Other |

520 |

|

|

Hotel/motel/inn |

312 |

|

|

|

|

|

|

|

|

Nursing home |

313 |

|

|

|

|

|

|

|

|

Shopping mall |

314 |

|

|

|

|

|

|

|

|

Other |

320 |

|

|

|

|

|

|