Get Maine Sale Agreement Form in PDF

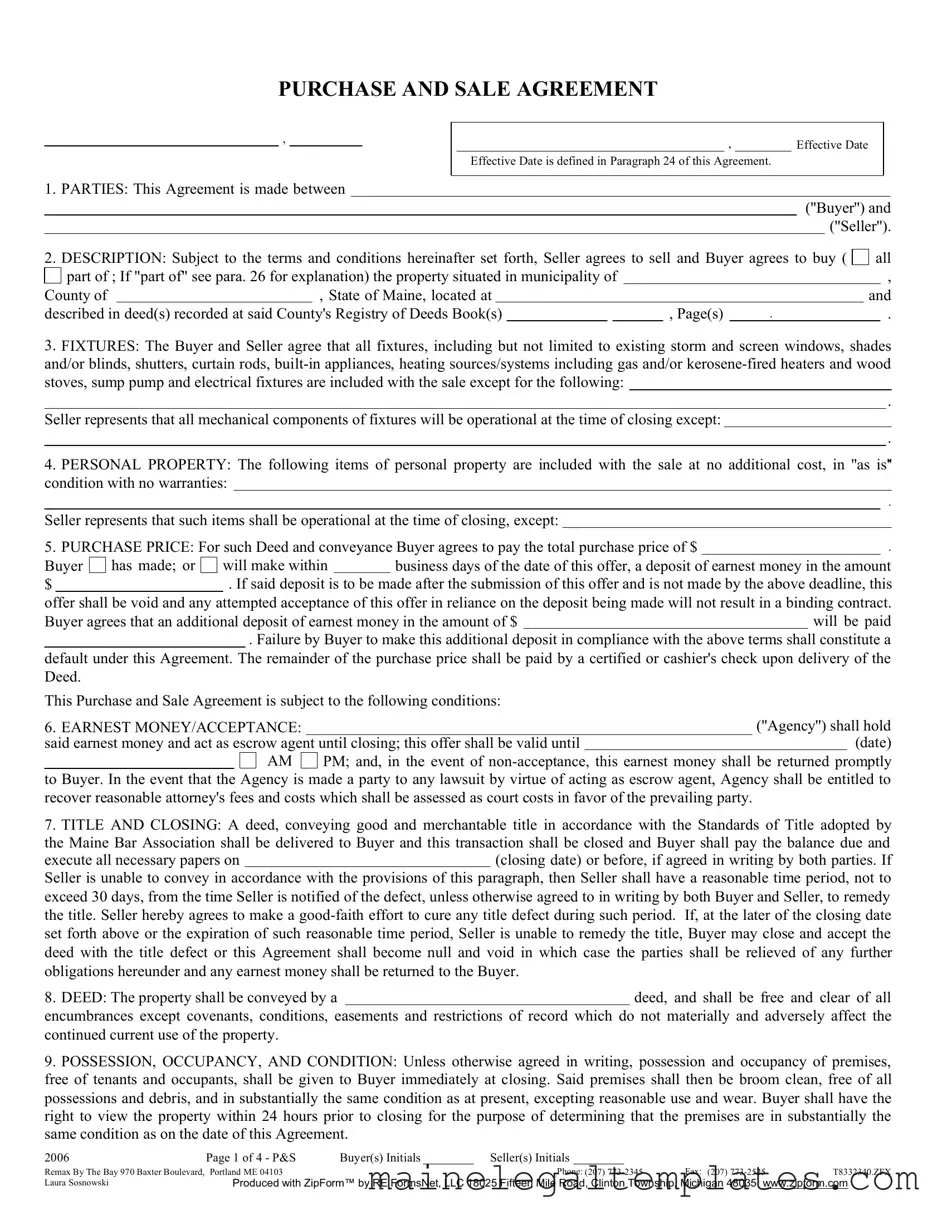

The Maine Sale Agreement form serves as a crucial document in real estate transactions, establishing a clear framework for the sale of property between buyers and sellers. This agreement outlines essential details such as the effective date, parties involved, and a comprehensive description of the property being sold, including its location and legal description. It addresses fixtures that are included in the sale, ensuring that both parties agree on what remains with the property. Personal property may also be included, but it is sold "as is," without warranties. The purchase price is a central component, with stipulations regarding earnest money deposits and payment methods. Additionally, the agreement covers title transfer, closing procedures, and the conditions under which possession is granted to the buyer. It also details responsibilities related to risk of loss, insurance, and proration of expenses like taxes and utilities. Buyers are encouraged to conduct due diligence, with the option to terminate the agreement based on unsatisfactory investigation results. This form not only facilitates a smoother transaction but also helps protect the interests of both parties involved.

Dos and Don'ts

When filling out the Maine Sale Agreement form, there are important guidelines to follow. Here’s a helpful list of things to do and avoid:

- Do read the entire agreement carefully before filling it out.

- Do clearly state the names of both the Buyer and Seller.

- Do provide accurate property details, including the municipality and county.

- Do ensure that all financial figures, including the purchase price and deposits, are correct.

- Do specify any included fixtures and personal property in the sale.

- Don't leave any sections blank; fill in all required information.

- Don't make assumptions about the terms; clarify any uncertainties with your agent.

- Don't forget to include deadlines for deposits and other actions.

- Don't overlook the importance of signing and dating the agreement.

By following these guidelines, you can help ensure a smoother process when completing the Maine Sale Agreement form.

Key takeaways

- Understand the Effective Date: The effective date is crucial as it marks the start of the agreement. Be sure to fill this out accurately, as it impacts all deadlines and obligations.

- Clearly Define the Parties: Ensure that the names of both the Buyer and Seller are correctly filled in. This clarity helps avoid confusion later in the transaction.

- Detail the Property Description: Provide a thorough description of the property, including the municipality, county, and any relevant deed information. This ensures everyone is on the same page regarding the property being sold.

- Include All Fixtures and Personal Property: Specify which fixtures and personal property are included in the sale. This prevents disputes about what is part of the transaction and what is not.

- Be Aware of Earnest Money Requirements: The agreement outlines the need for earnest money and the consequences of failing to meet deposit deadlines. Timely deposits are essential to keep the offer valid.

- Conduct Due Diligence: Buyers are encouraged to perform investigations on the property. This step is vital to ensure satisfaction with the property's condition and to avoid potential issues post-purchase.

Instructions on Filling in Maine Sale Agreement

Filling out the Maine Sale Agreement form is a crucial step in the property transaction process. This document outlines the terms of the sale, ensuring that both the buyer and seller understand their rights and responsibilities. To complete the form accurately, follow these steps carefully.

- Effective Date: Write the effective date of the agreement in the designated space.

- Parties: Fill in the names of the Buyer and Seller in the appropriate fields.

- Description: Provide the complete address of the property, including municipality, county, and state. Reference the deed information by including the book and page numbers from the Registry of Deeds.

- Fixtures: List any fixtures included in the sale. Specify any exceptions to this list.

- Personal Property: Identify any personal property included in the sale at no additional cost. Again, mention any exceptions.

- Purchase Price: State the total purchase price and the amount of the earnest money deposit. Include deadlines for these payments.

- Earnest Money/Acceptance: Specify the agency holding the earnest money and the validity period of the offer.

- Title and Closing: Indicate the closing date and any conditions regarding the title transfer.

- Deed: Confirm that the property will be conveyed free of encumbrances, except as noted.

- Possession: State when possession of the property will be given to the Buyer.

- Risk of Loss: Acknowledge that the Seller assumes the risk of loss until closing.

- Prorations: Identify any items that will be prorated at closing, such as taxes and utilities.

- Property Disclosure Form: Confirm receipt of the Seller's Property Disclosure Form.

- Due Diligence: List any investigations the Buyer intends to conduct and the timeline for reporting results.

- Home Service Contracts: Indicate whether the property will be covered by a Home Warranty Insurance.

- Financing: If applicable, detail the financing terms, including loan amount and interest rate.

- Agency Disclosure: Acknowledge the agency relationships involved in the transaction.

- Mediation: Agree to mediation for any disputes arising from the agreement.

- Default: Understand the consequences of default by either party.

- Prior Statements: Confirm that all agreements are contained within the document.

- Heirs/Assigns: Acknowledge that the agreement extends to heirs and assigns.

- Counterparts: Recognize that the agreement can be signed in counterparts.

- Addenda: Note any additional conditions or disclosures that apply.

- Effective Date/Notice: Confirm how notices will be communicated between parties.

- Confidentiality: Agree to the disclosure of information necessary for closing.

- Other Conditions: Fill in any additional conditions as needed.

- Signatures: Ensure both Buyer and Seller sign and date the agreement, along with their mailing addresses.

After completing the form, review it thoroughly to ensure all information is accurate. Both parties should retain a copy for their records. This agreement will guide the sale process and protect the interests of both the buyer and seller.

Find Popular Forms

Maine Bmv - All vehicle owners are required to certify the accuracy of submitted information.

In addition to providing a clear record of the transaction, a New York ATV Bill of Sale form can be conveniently accessed online, ensuring that both buyers and sellers have the necessary documentation at their fingertips. For detailed information and a template, you can visit https://nyforms.com/atv-bill-of-sale-template, which outlines the essential components and legal requirements involved in the sale of an ATV.

Maine Advance Directive Form - Your signature provides legal acknowledgment of your health care decisions outlined in the form.

Learn More on This Form

-

What is the Maine Sale Agreement form?

The Maine Sale Agreement form is a legally binding document used in real estate transactions in the state of Maine. It outlines the terms and conditions under which a seller agrees to sell a property and a buyer agrees to purchase it. This form includes essential details such as the purchase price, property description, and responsibilities of both parties.

-

What are the key components of the agreement?

The agreement includes several critical components:

- Parties involved (Buyer and Seller)

- Description of the property

- Purchase price and payment terms

- Fixtures and personal property included in the sale

- Conditions for closing and title transfer

- Provisions for risk of loss and damage

- Due diligence and inspection rights

-

How is the purchase price determined?

The purchase price is negotiated between the buyer and seller and stated clearly in the agreement. The buyer is also required to make an earnest money deposit, which demonstrates their commitment to the purchase. This deposit is typically held by an escrow agent until closing.

-

What happens if the seller cannot provide clear title?

If the seller is unable to convey clear title to the property, they have a maximum of 30 days to remedy the situation after being notified of the defect. If the title cannot be fixed within that time frame, the buyer has the option to either accept the property with the defect or void the agreement entirely, resulting in the return of their earnest money.

-

What is the significance of earnest money?

Earnest money is a deposit made by the buyer to show their serious intent to purchase the property. It is held in escrow and applied to the purchase price at closing. If the buyer fails to fulfill their obligations under the agreement, they may forfeit this deposit to the seller.

-

What are the buyer's rights regarding property inspections?

The buyer has the right to conduct various inspections of the property within a specified timeframe. This includes checking for structural issues, environmental concerns, and other factors that could affect the property's value or safety. If any inspection results are unsatisfactory, the buyer can terminate the agreement and receive their earnest money back.

-

What should buyers know about closing?

At closing, the buyer must pay the remaining balance of the purchase price and sign all necessary documents to transfer ownership. The property should be in the same condition as when the agreement was made, and the buyer has the right to inspect it 24 hours before closing to confirm this.

-

Can the agreement be modified after it is signed?

Yes, the agreement can be modified through a counter-offer or an addendum, as long as both parties agree to the changes. Any modifications must be documented in writing and signed by both the buyer and the seller to be legally binding.

-

What happens if there is a dispute?

In the event of a dispute, both parties are required to engage in mediation before pursuing legal action. This process encourages resolution without the need for litigation. If mediation fails, the parties may seek legal remedies as outlined in the agreement.

File Attributes

| Fact Name | Details |

|---|---|

| Effective Date | The Effective Date is defined in Paragraph 24 of the Maine Sale Agreement. |

| Governing Law | This Agreement is governed by the laws of the State of Maine. |

| Fixtures Included | All fixtures, such as built-in appliances and heating systems, are included unless otherwise stated. |

| Earnest Money | The Buyer must make a deposit of earnest money, which is required to validate the offer. |

Documents used along the form

The Maine Sale Agreement form serves as a foundational document in real estate transactions, outlining the terms and conditions under which a property is bought and sold. However, it is often accompanied by several other important forms and documents that help ensure a smooth transaction. Below is a list of these additional documents, each serving a specific purpose in the process.

- Property Disclosure Form: This document provides potential buyers with crucial information about the property's condition, including any known issues or defects. It is designed to promote transparency and protect both parties by ensuring the buyer is aware of any concerns before finalizing the sale.

- Earnest Money Agreement: This form outlines the amount of money the buyer will deposit to demonstrate their commitment to the purchase. It specifies how this money will be handled and under what circumstances it may be forfeited or returned, thus safeguarding both buyer and seller interests.

- Boat Bill of Sale: This document is crucial for the sale of any boat or watercraft in New York. It captures essential information including the details of both the buyer and seller, as well as the description of the vessel and the sale price. For more details, refer to Templates and Guide.

- Title Report: A title report verifies the legal ownership of the property and checks for any liens or encumbrances that could affect the sale. This document is essential for ensuring that the seller has the right to sell the property and that the buyer will receive clear title upon closing.

- Closing Statement: This document summarizes the financial aspects of the transaction, including the purchase price, closing costs, and any prorations. It is prepared by the closing agent and is typically reviewed and signed by both parties at the closing meeting.

- Inspection Reports: Buyers often obtain various inspection reports, such as home, pest, or environmental inspections. These reports provide insights into the property's condition and can influence the buyer's decision to proceed with the purchase or negotiate repairs.

- Financing Contingency Addendum: If the sale is contingent upon the buyer securing financing, this addendum outlines the terms and conditions related to the loan. It specifies deadlines for obtaining loan approval and the consequences if financing is not secured.

- Home Warranty Agreement: This document offers the buyer protection against potential repair costs for certain systems and appliances within the home for a specified period after closing. It can provide peace of mind for buyers, knowing that they have coverage for unexpected issues.

- Agency Disclosure Form: This form clarifies the roles and responsibilities of real estate agents involved in the transaction. It ensures that both the buyer and seller understand the nature of the agency relationship and any potential conflicts of interest.

- Counteroffer Form: In situations where the seller does not accept the initial offer, this document allows the seller to propose changes to the terms. It facilitates negotiation and helps both parties reach a mutually agreeable arrangement.

- Final Walk-Through Agreement: This document confirms that the buyer has had the opportunity to inspect the property one last time before closing. It ensures that the property is in the agreed-upon condition and allows the buyer to address any last-minute concerns.

These documents, when used alongside the Maine Sale Agreement, create a comprehensive framework for the real estate transaction. They help clarify expectations, protect the interests of both parties, and facilitate a successful transfer of ownership.

Misconceptions

- Misconception 1: The Maine Sale Agreement is a simple form that requires no additional information.

- Misconception 2: The earnest money deposit is optional.

- Misconception 3: The seller is responsible for all repairs before closing.

- Misconception 4: Buyers can back out of the agreement for any reason.

- Misconception 5: Once signed, the agreement cannot be changed.

Many believe that the Maine Sale Agreement is straightforward and doesn't need further details. However, it actually requires specific information about the property, parties involved, and terms of sale. Each section must be filled out accurately to ensure a valid agreement.

Some buyers think that the earnest money deposit is just a suggestion. In reality, making this deposit is often a requirement to secure the agreement. Failing to pay the deposit on time can void the offer, leading to potential complications.

It's a common belief that sellers must fix everything before the sale is finalized. However, the agreement typically states that the property is sold "as-is," meaning the buyer accepts the property in its current condition, with any existing issues.

Many buyers think they can easily withdraw from the agreement without consequences. In fact, there are specific conditions and timelines outlined in the agreement. If these are not followed, the buyer may face penalties, including losing their earnest money.

Some people assume that a signed agreement is set in stone. However, both parties can negotiate and amend the terms before closing. Any changes must be documented and agreed upon in writing to be enforceable.

Document Preview

PURCHASE AND SALE AGREEMENT

,

|

, |

|

Effective Date |

Effective Date is defined in Paragraph 24 of this Agreement. |

|

||

1. |

PARTIES: This Agreement is made between |

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

(''Buyer'') and |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

(''Seller''). |

||

2. |

DESCRIPTION: Subject to the terms and conditions hereinafter set forth, Seller agrees to sell and Buyer agrees to buy ( |

all |

|||||||||||||

|

part of ; If "part of" see para. 26 for explanation) the property situated in municipality of |

|

|

|

|

|

|

, |

|||||||

County of |

|

, State of Maine, located at |

|

|

|

|

|

|

and |

||||||

described in deed(s) recorded at said County's Registry of Deeds Book(s) |

|

|

|

|

, Page(s) |

. |

|

|

|

. |

|||||

3.FIXTURES: The Buyer and Seller agree that all fixtures, including but not limited to existing storm and screen windows, shades and/or blinds, shutters, curtain rods,

.

Seller represents that all mechanical components of fixtures will be operational at the time of closing except:

.

4.PERSONAL PROPERTY: The following items of personal property are included with the sale at no additional cost, in ''as is''. condition with no warranties:

|

|

|

|

|

|

|

. |

|

Seller represents that such items shall be operational at the time of closing, except: |

|

|

|

|||||

5. PURCHASE PRICE: For such Deed and conveyance Buyer agrees to pay the total purchase price of $ |

|

. |

||||||

Buyer |

has made; or |

will make within |

|

business days of the date of this offer, a deposit of earnest money in the amount |

||||

$ |

|

|

. If said deposit is to be made after the submission of this offer and is not made by the above deadline, this |

|||||

offer shall be void and any attempted acceptance of this offer in reliance on the deposit being made will not result in a binding contract.

Buyer agrees that an additional deposit of earnest money in the amount of $ |

|

will be paid |

.Failure by Buyer to make this additional deposit in compliance with the above terms shall constitute a default under this Agreement. The remainder of the purchase price shall be paid by a certified or cashier's check upon delivery of the Deed.

This Purchase and Sale Agreement is subject to the following conditions:

6. EARNEST MONEY/ACCEPTANCE: |

|

|

(''Agency'') shall hold |

||

said earnest money and act as escrow agent until closing; this offer shall be valid until |

|

|

(date) |

||

|

AM |

PM; and, in the event of |

|||

to Buyer. In the event that the Agency is made a party to any lawsuit by virtue of acting as escrow agent, Agency shall be entitled to recover reasonable attorney's fees and costs which shall be assessed as court costs in favor of the prevailing party.

7.TITLE AND CLOSING: A deed, conveying good and merchantable title in accordance with the Standards of Title adopted by the Maine Bar Association shall be delivered to Buyer and this transaction shall be closed and Buyer shall pay the balance due and

execute all necessary papers on(closing date) or before, if agreed in writing by both parties. If

Seller is unable to convey in accordance with the provisions of this paragraph, then Seller shall have a reasonable time period, not to exceed 30 days, from the time Seller is notified of the defect, unless otherwise agreed to in writing by both Buyer and Seller, to remedy the title. Seller hereby agrees to make a

8. DEED: The property shall be conveyed by adeed, and shall be free and clear of all

encumbrances except covenants, conditions, easements and restrictions of record which do not materially and adversely affect the continued current use of the property.

9.POSSESSION, OCCUPANCY, AND CONDITION: Unless otherwise agreed in writing, possession and occupancy of premises, free of tenants and occupants, shall be given to Buyer immediately at closing. Said premises shall then be broom clean, free of all possessions and debris, and in substantially the same condition as at present, excepting reasonable use and wear. Buyer shall have the right to view the property within 24 hours prior to closing for the purpose of determining that the premises are in substantially the same condition as on the date of this Agreement.

2006 |

Page 1 of 4 - P&S |

Buyer(s) Initials |

|

Seller(s) Initials |

|

|

|

|

Remax By The Bay 970 Baxter Boulevard, |

Portland ME 04103 |

|

|

Phone: (207) |

Fax: (207) |

T8332340.ZFX |

||

Laura Sosnowski |

Produced with ZipForm™ by RE FormsNet, LLC 18025 Fifteen Mile Road, Clinton Township, Michigan 48035 www.zipform.com |

|||||||

10.RISK OF LOSS, DAMAGE, DESTRUCTION AND INSURANCE: Prior to closing, risk of loss, damage, or destruction of premises shall be assumed solely by the Seller. Seller shall keep the premises insured against fire and other extended casualty risks prior to closing. If the premises are damaged or destroyed prior to closing, Buyer may either terminate this Agreement and be refunded the earnest money, or close this transaction and accept the premises

11.PRORATIONS: The following items, where applicable, shall be prorated as of the date of closing: collected rent, association

fees, (other). The day of closing is counted as a Seller day. Metered utilities such as electricity,

water and sewer will be paid through the date of closing by Seller. Fuel in tank shall be paid by Buyer at cash price as of date of closing. Real estate taxes shall be prorated as of the date of closing (based on municipality's fiscal year). Seller is responsible for any unpaid taxes for prior years. If the amount of said taxes is not known at the time of closing, they shall be apportioned on the basis of the taxes assessed for the preceding year with a reapportionment as soon as the new tax rate and valuation can be ascertained, which latter provision shall survive closing. Buyer and Seller will each pay their transfer tax as required by State of Maine.

12.PROPERTY DISCLOSURE FORM: Buyer acknowledges receipt of Seller's Property Disclosure Form and is encouraged to seek information from professionals regarding any specific issue or concern. The disclosure is not a warranty of the condition of the property and is not part of this Agreement.

13.DUE DILIGENCE: Buyer is encouraged to seek information from professionals regarding any specific issue or concern. Agent makes no warranties regarding the condition, permitted use or value of Sellers' real or personal property. This Agreement is subject to the following investigations, with results being satisfactory to Buyer:

TYPE OF INVESTIGATION YES NO |

RESULTS REPORTED |

TYPE OF INVESTIGATION YES |

|

NO RESULTS REPORTED |

|||||||||||||

|

|

|

|

|

TO SELLER |

|

|

|

|

|

|

|

|

TO SELLER |

|

||

a. |

General Building |

|

|

|

Within |

|

days |

h. Mold |

|

|

|

Within |

|

days |

|||

b. |

Chimney Level II |

|

|

|

Within |

|

days |

i. |

Lead Paint |

|

|

|

Within |

|

days |

||

c. |

Environmental Scan |

|

|

|

Within |

|

days |

j. |

Arsenic Treated Wood |

|

|

|

Within |

|

days |

||

d. |

Sewage Disposal |

|

|

|

Within |

|

days |

k. |

Pests |

|

|

|

Within |

|

days |

||

e. |

Water Quality |

|

|

|

Within |

|

days |

l. |

Pool |

|

|

|

Within |

|

days |

||

|

(including but not limited to radon, arsenic, lead, etc.) |

|

m. Zoning |

|

|

|

Within |

|

days |

||||||||

f. |

Water Quantity |

|

|

|

Within |

|

days |

n. |

Flood Plain |

|

|

|

Within |

|

days |

||

g. Air Quality |

|

|

|

Within |

|

days |

o. |

Code Conformance |

|

|

|

Within |

|

days |

|||

|

(including but not limited to asbestos, radon, etc.) |

|

p. |

Insurance |

|

|

|

Within |

|

days |

|||||||

|

|

|

|

|

|

|

|

q. |

Other |

|

|

|

|

|

Within |

|

days |

All investigations will be done by persons chosen and paid for by Buyer in Buyer's sole discretion. If the result of any investigation or other condition specified herein is unsatisfactory to Buyer, Buyer will declare the Agreement null and void by notifying Seller in writing within the specified number of days, and any earnest money shall be returned to Buyer. If the result of any investigation or other condition specified herein is unsatisfactory to Buyer in Buyer's sole discretion, and Buyer wishes to pursue remedies other than voiding the Agreement, Buyer must do so to full resolution within the time period set forth above; otherwise this contingency is waived. If Buyer does not notify Seller that an investigation is unsatisfactory within the time period set forth above, this contingency is waived by Buyer. In the absence of investigation(s) mentioned above, Buyer is relying completely upon Buyer's own opinion as to the condition of the property. Since the determination on the acceptability of the results of the above investigations rests exclusively with Buyer, Seller's signature on this Agreement shall constitute written authorization to release the earnest money to Buyer if Buyer terminates the Agreement under this paragraph and Seller agrees to hold the agency holding the earnest money harmless for returning the earnest money to Buyer in the event of such termination.

14.HOME SERVICE CONTRACTS: At closing, the property

Program to be paid by |

Seller |

Buyer at a price of $ |

will

will not be covered by a Home Warranty Insurance

.

15. FINANCING: This Agreement |

is |

is not subject to Financing. If subject to Financing: |

|

|

||||||

a. This Agreement is subject to Buyer obtaining a |

|

|

loan of |

|

% of the purchase price, at an |

|||||

interest rate not to exceed |

|

|

|

|

% and amortized over a period of |

|

|

years. |

||

b. Buyer to provide Seller with letter from lender showing that Buyer has made application and, subject to verification of

information, is qualified for the loan requested within days from the Effective Date of the Agreement. If Buyer

fails to provide Seller with such letter within said time period, Seller may terminate this Agreement and the earnest money shall be returned to Buyer.

c. Buyer to provide Seller with loan commitment letter from lender showing that Buyer has secured the loan commitment

withindays of the Effective Date of the Agreement. If Buyer fails to provide Seller with this loan

commitment letter within said time period, Seller may deliver notice to Buyer that this Agreement is terminated three business days after delivery of such notice unless Buyer delivers the loan commitment letter before the end of the

d.Buyer hereby authorizes, instructs and directs its lender to communicate the status of the Buyer's loan application to Seller or Seller's agent.

e.After (b) or (c) are met, Buyer is obligated to notify Seller in writing if the lender notifies Buyer that it is unable or unwilling to proceed under the terms of the financing. Any failure by Buyer to notify Seller within two business days of receipt by Buyer of notice from the lender shall be a default under this Agreement.

f. |

Buyer agrees to pay no more than |

|

points. Seller agrees to pay up to $ |

|

toward Buyer's |

||||

|

actual |

|

|||||||

2006 |

Page 2 of 4 - P&S |

Buyer(s) Initials |

|

Seller(s) Initials |

|

|

|

||

|

Produced with ZipForm™ by RE FormsNet, LLC 18025 Fifteen Mile Road, Clinton Township, Michigan 48035 www.zipform.com |

T8332340.ZFX |

|||||||

g. Buyer's ability to obtain financing |

is |

is not subject to the sale of another property. See addendum Yes |

No |

. |

h.Buyer may choose to pay cash instead of obtaining financing. If so, buyer shall notify seller in writing and the Agreement shall no longer be subject to financing, and Seller's right to terminate pursuant to the provisions of this paragraph shall be void.

16.AGENCY DISCLOSURE: Buyer and Seller acknowledge they have been advised of the following relationships:

|

of |

|

is a |

Licensee |

|

Agency |

|

Laura & Michael Sosnowski |

of |

Remax By the Bay |

is a |

Licensee |

|

Agency |

|

Seller Agent

Disc Dual Agent

Seller Agent

Disc Dual Agent

X

Buyer Agent

Transaction Broker

Buyer Agent

Transaction Broker

If this transaction involves Disclosed Dual Agency, the Buyer and Seller acknowledge the limited fiduciary duties of the agents and hereby consent to this arrangement. In addition, the Buyer and Seller acknowledge prior receipt and signing of a Disclosed Dual Agency Consent Agreement.

17.MEDIATION: Except as provided below, any dispute or claim arising out of or relating to this Agreement or the property addressed in this Agreement shall be submitted to mediation in accordance with the Maine Residential Real Estate Mediation Rules. Buyer and Seller are bound to mediate in good faith and pay their respective mediation fees. If a party does not agree first to go to mediation, then that party will be liable for the other party's legal fees in any subsequent litigation regarding that same matter in which the party who refused to go to mediation loses in that subsequent litigation. This clause shall survive the closing of the transaction. Earnest money disputes subject to the jurisdiction of small claims court will be handled in that forum.

18.DEFAULT: In the event of default by the Buyer, Seller may employ all legal and equitable remedies, including without limitation, termination of this Agreement and forfeiture by Buyer of the earnest money. In the event of a default by Seller, Buyer may employ all legal and equitable remedies, including without limitation, termination of this Agreement and return to Buyer of the earnest money. Agency acting as escrow agent has the option to require written releases from both parties prior to disbursing the earnest money to either Buyer or Seller.

19.PRIOR STATEMENTS: Any representations, statements and agreements are not valid unless contained herein. This Agreement completely expresses the obligations of the parties.

20.HEIRS/ASSIGNS: This Agreement shall extend to and be obligatory upon heirs, personal representatives, successors, and assigns of the Seller and the assigns of the Buyer.

21.COUNTERPARTS: This Agreement may be signed on any number of identical counterparts, such as a faxed copy, with the same binding effect as if the signatures were on one instrument. Original or faxed signatures are binding.

22.ADDENDA: Lead Paint - Explain:

Yes

No ; Other -

Yes

No

The Property Disclosure Form is not an addendum and not part of this Agreement.

23. SHORELAND ZONE SEPTIC SYSTEM: Seller represents that the property does |

does not contain a septic system within |

the Shoreland Zone. If the property does contain a septic system located in the Shoreland Zone, Seller agrees to provide certification at closing indicating whether the system has/has not malfunctioned within 180 days prior to closing.

24.EFFECTIVE DATE/NOTICE: Any notice, communication or document delivery requirements hereunder may be satisfied by providing the required notice, communication or documentation to the party or their agent. Withdrawals of offers and counteroffers will be effective upon communication, verbally or in writing. This Agreement is a binding contract when signed by both Buyer and Seller and when that fact has been communicated. Agent is authorized to complete Effective Date on Page 1 of this Agreement. Except as

expressly set forth to the contrary, the use of "by (date)" or "within X days'' shall refer to calendar days being counted from the

Effective Date as noted on Page 1 of the Agreement, beginning with the first day after the Effective Date and ending at 5:00 p.m. Eastern Time on the last day counted.

25.CONFIDENTIALITY: Buyer and Seller authorize the disclosure of the information herein to the agents, attorneys, lenders, appraisers, inspectors, investigators and others involved in the transaction necessary for the purpose of closing this transaction. Buyer and Seller authorize the lender and/or closing agent preparing the closing statement to release a copy of the closing statement to the parties and their agents prior to, at and after the closing.

26.OTHER CONDITIONS:

2006 |

Page 3 of 4 - P&S |

Buyer(s) Initials |

|

Seller(s) Initials |

|

|

|

|

Produced with ZipForm™ by RE FormsNet, LLC 18025 Fifteen Mile Road, Clinton Township, Michigan 48035 www.zipform.com |

T8332340.ZFX |

|||||

A copy of this Agreement is to be received by all parties and, by signature, receipt of a copy is hereby acknowledged. If not fully understood, contact an attorney. This is a Maine contract and shall be construed according to the laws of Maine.

Seller acknowledges that State of Maine law requires buyers of property owned by

Buyer acknowledges that Maine law requires continuing interest in the property and any back up offers to be communicated by the listing agent to the Seller.

Buyer's Mailing address is |

|

|

|

. |

|

|

|

|

|

|

|

BUYER |

DATE |

BUYER |

DATE |

||

Seller accepts the offer and agrees to deliver the

Seller's Mailing address is |

|

|

|

. |

|

|

|

|

|

|

|

SELLER |

DATE |

SELLER |

DATE |

||

The parties acknowledge that until signed by Buyer, Seller's signature constitutes only an offer to sell on the above terms and the offer will expire unless accepted by Buyer's signature with communication of such signature to Seller by (date)

(time) |

|

|

|

AM |

|

PM. |

|

|

|

|

|

|

|

|

|

|

|

|

|

SELLER |

|

|

|

|

DATE |

SELLER |

DATE |

||

The Buyer hereby accepts the counter offer set forth above.

BUYER |

DATE |

BUYER |

DATE |

|||

EXTENSION: The time for the performance of this Agreement is extended until |

|

|

. |

|||

|

|

|

|

|

DATE |

|

|

|

|

|

|

|

|

BUYER |

DATE |

SELLER |

DATE |

|||

|

|

|

|

|

|

|

BUYER |

DATE |

SELLER |

DATE |

|||

Maine Association of REALTORS®/Copyright © 2006

All Rights Reserved.

Page 4 of 4 - P&S

Produced with ZipForm™ by RE FormsNet, LLC 18025 Fifteen Mile Road, Clinton Township, Michigan 48035 www.zipform.com |

T8332340.ZFX |