Get Maine Rew 5 Form in PDF

The Maine REW-5 form serves as a crucial tool for individuals and entities looking to navigate the complexities of real estate transactions in the state. Specifically designed for sellers who are nonresidents of Maine, this form allows them to request an exemption or reduction in the withholding of Maine income tax during the sale of real property. As part of the process, sellers must provide detailed information about the property, including its physical address, acquisition details, and the method of ownership transfer—whether through purchase, inheritance, or gift. Additionally, the form requires sellers to disclose their ownership percentage, allowable closing costs, and any capital improvements made to the property. A critical aspect of the REW-5 is its deadline; it must be submitted at least five business days prior to closing to ensure timely processing. If you’re planning to sell real estate in Maine, understanding the nuances of this form can significantly impact your financial obligations and overall experience in the transaction. The Maine Revenue Services is available to assist with any questions, ensuring that sellers are well-informed and prepared to meet their tax responsibilities.

Dos and Don'ts

- Do submit the form at least 5 business days before closing.

- Do provide accurate information for all required fields, including names and addresses.

- Do attach any necessary documentation to support your claims, such as proof of purchase price.

- Do include both your name and your spouse’s name if applicable.

- Do indicate the method of acquisition clearly (purchase, inherited, or gift).

- Don't forget to sign and date the application before submission.

- Don't submit the form via mail if you need a quicker response; use email or fax instead.

- Don't leave any fields blank; provide estimates if necessary.

- Don't mix up closing costs from the original purchase with those from the current sale.

- Don't forget to consult IRS guidelines if you're unsure about reporting the sale on your tax return.

Key takeaways

- Form Purpose: The Maine REW-5 form is used to request an exemption or reduction in withholding of Maine income tax when selling real property in Maine.

- Eligibility: Sellers who are nonresidents of Maine can file this form. This includes individuals, corporations, and various other entities.

- Submission Timeline: The form must be submitted at least 5 business days before the closing date. If mailed, expect an additional 2-3 weeks for processing.

- Documentation: Maine Revenue Services may ask for additional documents to support the exemption or reduction request.

- Withholding Rate: The standard withholding rate is 2.5% of the total consideration from the sale. Reduced rates may apply based on the seller's tax liability.

- Multiple Sellers: If there are multiple sellers, each must complete a separate REW-5 form unless they are married and filing jointly.

- Closing Costs: Applicants should detail both original and current closing costs on the form, as these can impact the withholding calculation.

- Capital Improvements: Only capital improvements, not repairs, should be reported. This distinction can affect the overall tax liability.

- Reporting Sale: Indicate how the sale will be reported on the seller’s federal income tax return. This information is crucial for tax assessment.

- Power of Attorney: If someone else will represent the seller, a Power of Attorney must be completed. This grants them authority to discuss tax records related to the form.

Instructions on Filling in Maine Rew 5

Completing the Maine REW-5 form is a crucial step for sellers looking to request an exemption or reduction in withholding of Maine income tax on the sale of real property. It's important to gather all necessary information and submit the form at least five business days before the closing date. Follow these steps carefully to ensure your application is complete and accurate.

- Enter the applicant’s name: Include both the seller's name and spouse's name if applicable.

- Provide the mailing address: Write the current mailing address of the applicant.

- Fill in the SSN or EIN: Enter the Social Security Number or Employer Identification Number for the applicant.

- List the daytime phone number: Provide a contact number where the applicant can be reached.

- Include the applicant’s email address: Provide an email address for correspondence.

- Indicate the ownership percentage: Fill in the percentage of ownership the applicant has in the property.

- List all sellers: Write the names of all sellers involved in the transaction.

- Enter the buyers' names: Provide the names of the buyer(s) for the property.

- Fill in property details: Include the MAP, BLOCK, LOT, and SUB-LOT numbers along with the physical address and municipality/township.

- State the date the property was acquired: Enter the date when the seller acquired the property.

- Indicate the method of acquisition: Select from purchase, inheritance, or gift and provide necessary documentation.

- List allowable closing costs: Enter the closing costs from the original purchase of the property.

- Provide capital improvements: Detail any capital improvements made to the property and their costs.

- State the total sales price: Enter the total sales price of the current pending sale and the closing date.

- List estimated allowable current closing costs: Provide the estimated closing costs for the current sale.

- If applicable, indicate rental/commercial use: State the length of time the property was used for rental or commercial purposes and provide accumulated depreciation.

- Describe how the sale will be reported: Indicate how the sale will be reported on the seller’s federal income tax return.

- Sign and date the form: The applicant must sign and date the form to verify the information is accurate.

After completing the form, submit it via email or fax to the Maine Revenue Services. Ensure that all required documentation is attached. If additional information is needed, MRS may contact you. Be mindful of the processing time if mailing the form, as it can take an additional 2-3 weeks.

Find Popular Forms

Probate in Maine - Filing fees are due upon submission of the form, such as fees for notices and court services.

In addition to serving as a critical legal record, the New York Boat Bill of Sale form can help streamline the process for both buyers and sellers, ensuring all necessary details are captured accurately. For those looking for a reliable template, nyforms.com/boat-bill-of-sale-template/ provides an easy-to-use resource to facilitate this important transaction.

Registering a Salvage Title in Texas - An authorized representative can also sign this form on behalf of the owner.

Learn More on This Form

-

What is the purpose of the Maine REW 5 form?

The Maine REW 5 form is used to request an exemption or reduction in withholding of Maine income tax on the sale of real property located in Maine. This form is specifically for sellers who are nonresidents of Maine at the time of closing. By submitting this form, sellers can potentially reduce the amount of tax withheld from the proceeds of their property sale.

-

Who is eligible to file the REW 5 form?

Any seller of Maine real property who is a nonresident at the time of closing can file the REW 5 form. This includes individuals, corporations, partnerships, and other entities. If there are multiple sellers, each must complete a separate form unless they are married and will file a joint Maine individual income tax return.

-

How far in advance must the REW 5 form be submitted?

The REW 5 form must be submitted no fewer than 5 business days before the closing date of the property sale. If you choose to mail the form, be aware that processing may take an additional 2-3 weeks. To expedite the process, it is recommended to submit the form via email or fax.

-

What information is required on the REW 5 form?

The form requires several key pieces of information, including:

- The names and contact information of the seller(s) and buyer(s).

- The physical address and details of the property being sold.

- The date the seller acquired the property and the method of acquisition.

- Details regarding the sales price and any allowable closing costs.

- Information about how the sale will be reported on the seller's federal income tax return.

Providing accurate and complete information helps ensure a smoother processing experience.

-

What happens after submitting the REW 5 form?

Once the REW 5 form is submitted, Maine Revenue Services may request additional documentation before granting an exemption or reduction in withholding. If approved, the State Tax Assessor will issue a withholding certificate, which will allow for a reduced or eliminated withholding amount. Keep in mind that the withholding rate is typically 2.5% of the total consideration, but this can be adjusted based on the seller’s tax liability.

File Attributes

| Fact Name | Fact Description |

|---|---|

| Form Title | The form is officially titled "2021 Form REW-5 Request for Exemption or Reduction in Withholding of Maine Income Tax on the Disposition of Maine Real Property." |

| Governing Laws | This form operates under 36 M.R.S. §§ 5250-A(3)(B) & (4), which govern withholding tax on real property transactions. |

| Purpose | The form is used to request an exemption or reduction in withholding of Maine income tax when selling real property. |

| Submission Deadline | It must be submitted at least 5 business days before the closing date of the property sale. |

| Contact Information | For assistance, contact Maine Revenue Services at 207-626-8473 or email realestate.withholding@maine.gov. |

| Processing Time | If mailed, allow an additional 2-3 weeks for processing the request. |

| Eligibility | Only sellers who are nonresidents of Maine can file this form for the sale of Maine real property. |

| Withholding Rate | The standard withholding rate is 2.5% of the total consideration for the sale. |

| Power of Attorney | Designating a representative requires completing the Power of Attorney section of the form or submitting Form 2848-ME. |

| Additional Documentation | Maine Revenue Services may request further documentation before approving an exemption or reduction in withholding. |

Documents used along the form

The Maine REW 5 form is crucial for individuals seeking an exemption or reduction in the withholding of Maine income tax when selling real property. However, several other forms and documents often accompany this request to ensure compliance with state regulations and to provide necessary information for processing. Below is a list of these documents, each serving a specific purpose in the transaction process.

- Form 2848-ME: This is the Power of Attorney form specific to Maine. It allows the seller to designate a representative to handle tax matters on their behalf. This form is essential if the seller wants someone else to communicate with Maine Revenue Services regarding their tax obligations.

- HUD-1 Settlement Statement: This document details the closing costs and financial transactions that occur during the sale of real estate. It provides a comprehensive breakdown of all fees, ensuring transparency for both the seller and the buyer.

- New York Bill of Sale: A vital document serving as proof of a transaction between a buyer and seller, detailing the specifics of the sale. For further insights, refer to Templates and Guide.

- Real Estate Transfer Tax Declaration (RETTD): This form is required when transferring property in Maine. It documents the sale price and helps determine the applicable transfer tax. It is often used in conjunction with the REW 5 form to verify the sale details.

- Appraisal Report: If the property was inherited, an appraisal report may be necessary to establish the fair market value at the time of the decedent's death. This document supports claims regarding the property's value for tax purposes.

- Purchase and Sale Agreement: This contract outlines the terms of the sale between the buyer and seller. It includes details about the property, sale price, and any contingencies, serving as a foundational document for the transaction.

- Closing Statement: Similar to the HUD-1, this document summarizes the financial aspects of the closing process. It lists all the costs and credits associated with the sale, ensuring both parties are aware of their financial obligations.

- Tax Assessment Records: These records from the local municipality provide information about the property’s assessed value. They can be used to verify the original purchase price or to support claims regarding capital improvements made to the property.

Each of these documents plays a vital role in the process of selling real property in Maine. Together, they facilitate a smoother transaction, ensuring that all parties meet their legal obligations and have the necessary information to proceed with confidence.

Misconceptions

Misconceptions about the Maine REW 5 form can lead to confusion for sellers of real property. Below are five common misconceptions along with clarifications.

- All sellers must file a separate form. This is not entirely true. Married couples filing a joint Maine individual income tax return can complete one form together, listing both names and Social Security Numbers.

- Submitting the form is optional. In fact, submitting the REW 5 form is necessary if a seller wants to request an exemption or reduction in withholding of Maine income tax. It must be submitted no fewer than five business days before closing.

- Only residents of Maine can file this form. This is a misconception. Nonresidents of Maine who are selling real property in the state can also file the REW 5 form to request a reduction or exemption from withholding.

- Processing the form takes little time. Many assume that processing is quick, but if mailed, sellers should allow an additional 2-3 weeks for processing. Timely submission is crucial to avoid delays.

- All types of property sales require the REW 5 form. This is incorrect. If the property is subject to foreclosure and the consideration received does not exceed the debt secured by that property, no withholding is required, and the REW 5 form is not necessary.

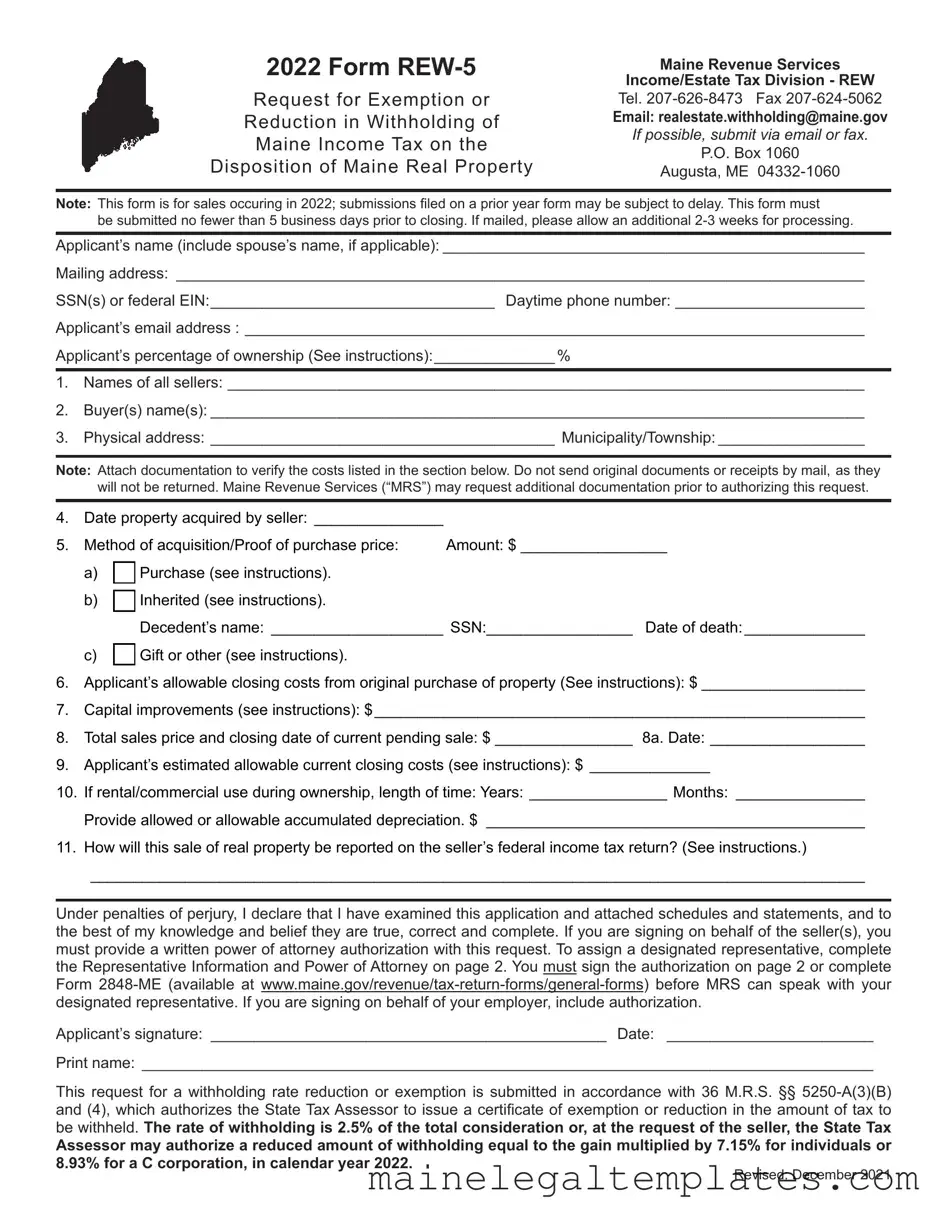

Document Preview

2022 Form

Request for Exemption or Reduction in Withholding of Maine Income Tax on the Disposition of Maine Real Property

Maine Revenue Services

Income/Estate Tax Division - REW

Tel.

Email: realestate.withholding@maine.gov

If possible, submit via email or fax.

P.O. Box 1060

Augusta, ME

Note: This form is for sales occuring in 2022; submissions filed on a prior year form may be subject to delay. This form must

be submitted no fewer than 5 business days prior to closing. If mailed, please allow an additional

Applicant’s name (include spouse’s name, if applicable): _________________________________________________

Mailing address: ________________________________________________________________________________

SSN(s) or federal EIN:_________________________________ Daytime phone number: ______________________

Applicant’s email address : ________________________________________________________________________

Applicant’s percentage of ownership (See instructions):______________ %

1.Names of all sellers: __________________________________________________________________________

2.Buyer(s) name(s): ____________________________________________________________________________

3.Physical address: ________________________________________ Municipality/Township: _________________

Note: Attach documentation to verify the costs listed in the section below. Do not send original documents or receipts by mail, as they will not be returned. Maine Revenue Services (“MRS”) may request additional documentation prior to authorizing this request.

4. |

Date property acquired by seller: _______________ |

|

||

5. |

Method of acquisition/Proof of purchase price: |

Amount: $ _________________ |

||

|

a) |

|

Purchase (see instructions). |

|

|

|

|

||

|

|

|

|

|

|

b) |

|

Inherited (see instructions). |

|

|

|

|

Decedent’s name: ____________________ SSN:_________________ Date of death:______________ |

|

c)

Gift or other (see instructions).

Gift or other (see instructions).

6.Applicant’s allowable closing costs from original purchase of property (See instructions): $ ___________________

7.Capital improvements (see instructions): $_________________________________________________________

8.Total sales price and closing date of current pending sale: $ ________________ 8a. Date: __________________

9.Applicant’s estimated allowable current closing costs (see instructions): $ ______________

10.If rental/commercial use during ownership, length of time: Years: ________________ Months: _______________

Provide allowed or allowable accumulated depreciation. $ ____________________________________________

11.How will this sale of real property be reported on the seller’s federal income tax return? (See instructions.)

__________________________________________________________________________________________

Under penalties of perjury, I declare that I have examined this application and attached schedules and statements, and to the best of my knowledge and belief they are true, correct and complete. If you are signing on behalf of the seller(s), you must provide a written power of attorney authorization with this request. To assign a designated representative, complete the Representative Information and Power of Attorney on page 2. You must sign the authorization on page 2 or complete Form

Applicant’s signature: ______________________________________________ Date: ________________________

Print name: _____________________________________________________________________________________

This request for a withholding rate reduction or exemption is submitted in accordance with 36 M.R.S. §§

be withheld. The rate of withholding is 2.5% of the total consideration or, at the request of the seller, the State Tax

Assessor may authorize a reduced amount of withholding equal to the gain multiplied by 7.15% for individuals or 8.93% for a C corporation, in calendar year 2022.

Revised: December 2021

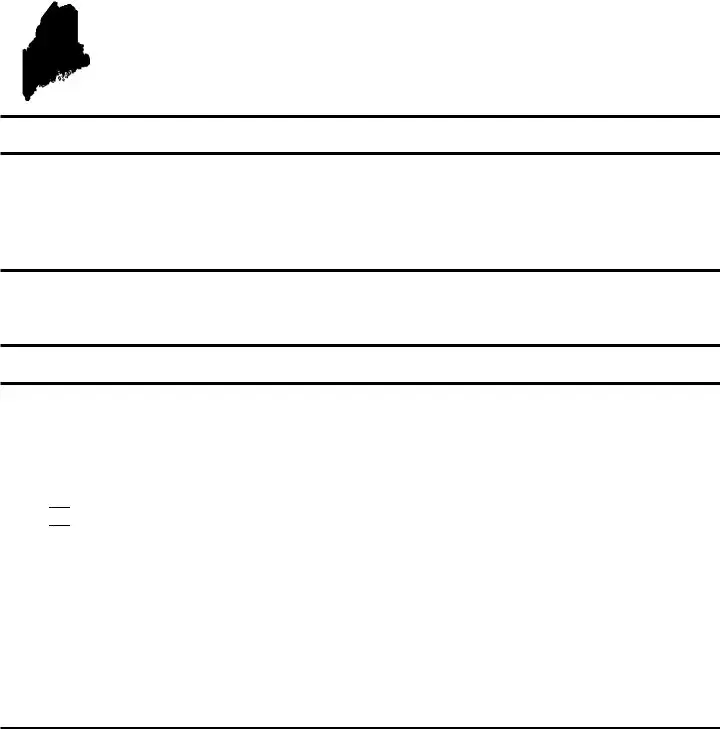

Representative Information (complete only if you want someone to represent you during the real estate withholding process)

Representative name (and title, if applicable)

Firm or company name

Mailing address

City, state, zip

Country (if not United States)

Email address

Telephone number

Limited Power of Attorney (complete only if you want someone to represent you during the real estate withholding process)

By signing below, the selling party appoints the individual named in the above section to act as their representative with authority to receive confidential information and to discuss your tax records, related to this form, with MRS. I understand

that my representative may not act on my behalf, unless I provide a Form

Seller signature

Print name (and title, if applicable)

Date

Additional seller signature (if applicable)

Print name (and title, if applicable)

Date

General Instructions

Purpose of Form: To request an exemption or reduction in withholding of Maine income tax on the disposition of Maine real property.

Who may File: A seller (individual, firm, partnership, association, society, club, corporation, estate, trust, business trust, receiver, assignee or any other group or combination acting as a unit) of Maine real property who, at the time of closing, is a nonresident of Maine.

Withholding Certificate Issued by the State Tax Assessor: A withholding certificate may be issued by the

State Tax Assessor to reduce or eliminate withholding on transfers of Maine real property interests by nonresidents.

The certificate may be issued if:

1.No tax is due on the gain from the transfer; or,

2.Reduced withholding is appropriate because the 2.5% amount exceeds the seller’s maximum Maine income tax liability on the gain realized from the sale. The maximum income tax liability is equal to the seller’s capital gain multiplied by 7.15% (8.93% for corporations).

If one of the above is applicable, apply for the certificate no later than five business days prior to closing. Do not apply if

the maximum Maine income tax liability exceeds 2.5% of the consideration.

Foreclosure Sale: If property is subject to foreclosure and the consideration received for the property does not exceed the debt secured by that property, no Maine income tax withholding is required. Foreclosure sale means a sale of real property incident to a foreclosure and includes a mortgagee’s sale of real estate owned property of which the mortgagee, or

of a previous foreclosure auction. MRS does not issue withholding exemption certificates for this type of foreclosure

sale (see Rule 803 and 36 M.R.S. §

2

Specific Instructions

Email Form

Applicant’s name: Enter the applicant’s (seller’s) name.

NOTE: If there are multiple sellers of the property, each

applicant (seller) must complete a separate Form REW-

5, except that married taxpayers that will file a joint Maine individual income tax return requesting a withholding exemption or reduction may complete one form, listing both names and SSN’s on the form.

Mailing address: Enter the applicant’s current mailing address.

Social Security Number (SSN) or Employer Identification

Number (EIN): Enter the SSN or EIN of the applicant listed on this form. If applicable, enter your spouse’s SSN.

Line 1. If applicant’s ownership percentage is less than 100%, all sellers must be listed on this line. The seller(s) are typically listed on the Purchase and Sale Agreement. Attach additional pages, if necessary.

Line 2. Enter the names(s) of the buyer(s). The buyers are typically listed on the Purchase and Sale Agreement. Attach additional pages, if necessary.

Line 3. Enter the physical address of the property being sold.

Line 4. Enter the date the seller acquired the property.

Line 5. Indicate the method by which the seller obtained ownership of the property.

a)If you purchased the property, attach verification of the original sales price, such as

b)If you inherited the property, provide a complete appraisal dated within six months of the decedent’s death or a copy of the tax assessment from the town. Enter the decedent’s name, SSN and the date of death in the spaces provided.

c)If you received the property as a gift, provide documents to verify the original purchase price paid by the previous owner. If you cannot locate these documents, the town where the property is located may have a record of the purchase price. As a general rule, for purposes of determining the gain, you will use the donor’s adjusted basis at the time of gift as your basis.

Line 6. Enter the amount of the allowable original closing costs you paid at the time of acquisition*. Also see line 9.

Line 7. Provide a list of capital improvements made to the home along with the cost of each improvement. Do

not include repairs made to the property. For example:

Cleaning or fixing a furnace is not a capital improvement, but installing a new furnace is. If you built the home, provide the information for the build. You can make a detailed list of the items purchased (including the cost of each and providing

receipts), provide a copy of the contract with the builder, provide the building permit filed with the town, or provide the tax assessment from the year you received the certification

of occupancy. Attach additional pages as needed.

Line 8. Enter the total gross sales price of the property. Do not subtract any fees. The sale price should match the sales price on the Purchase and Sales Agreement. If there are multiple sellers, list this seller’s ownership percentage.

Line 8a. Enter the closing date for the sale of this property.

Line 9. Enter the amount of the applicant’s allowable closing costs from the current sale of this property*. Also see line 6.

*Certain closing costs do not qualify. If available, enclose a copy of the

For more information about selling your home, determining basis, reporting the sale, capital improvements and costs, see IRS Publication 523.

Line 10. If the property was rented or used commercially, enter the allowed, or allowable, accumulated depreciation determined in accordance with the Internal Revenue Code.

Line 11. Indicate whether the sale will be reported as a gain, loss, exclusion, installment sale or

Representative Information & Limited Power of Attorney

Although not required, you may designate someone to represent you during the real estate withholding process. To do so, complete the Representative Information and Limited Power of Attorney sections on page 2 of Form

designated representative must be an individual, although a firm cannot be designated as your representative, an individual of a firm can be.

Appointing a Limited Power of Attorney designates a representative to receive confidential information and to discuss tax records related to your Form

with MRS. The designated representative may not act on your behalf, unless a completed Form

3