Legal Articles of Incorporation Template for Maine

Incorporating a business in Maine requires careful attention to the Articles of Incorporation form, a crucial document that lays the foundation for a corporation's legal existence. This form serves multiple purposes, including establishing the corporation's name, which must be unique and comply with state regulations. Additionally, it outlines the corporation's purpose, a statement that reflects the activities the business intends to engage in. The Articles of Incorporation also specify the number of shares the corporation is authorized to issue, an important factor that can influence investment and ownership structure. Furthermore, the form requires the identification of the registered agent, a designated individual or business entity responsible for receiving legal documents on behalf of the corporation. By completing this form accurately and submitting it to the appropriate state authority, business owners take a significant step toward formalizing their enterprise and ensuring compliance with Maine's corporate laws. Understanding the nuances of this form can empower entrepreneurs and help them navigate the complexities of starting a business in the Pine Tree State.

Dos and Don'ts

When filling out the Maine Articles of Incorporation form, it is essential to follow specific guidelines to ensure a smooth process. Here are some do's and don'ts to keep in mind:

- Do provide accurate and complete information in all sections of the form.

- Do include the name of your corporation, ensuring it complies with Maine naming requirements.

- Do designate a registered agent who has a physical address in Maine.

- Do review the form thoroughly for any errors or omissions before submission.

- Don't use prohibited words in your corporation's name, such as "bank" or "insurance" unless you meet specific criteria.

- Don't forget to pay the required filing fee, as this is necessary for processing your application.

Key takeaways

When filling out and using the Maine Articles of Incorporation form, there are several important points to keep in mind. Here are nine key takeaways:

- Understand the Purpose: The Articles of Incorporation establish your business as a legal entity in Maine. This document is essential for protecting personal assets.

- Gather Required Information: You will need details such as the name of the corporation, the purpose of the business, and the registered agent's information.

- Choose a Unique Name: The name of your corporation must be distinguishable from existing businesses registered in Maine. Conduct a name search to ensure availability.

- Designate a Registered Agent: A registered agent is required for receiving legal documents on behalf of the corporation. This can be an individual or a business entity.

- Include the Duration: Specify whether the corporation will exist indefinitely or for a limited duration. This is a crucial detail in your filing.

- File with the Secretary of State: Submit the completed Articles of Incorporation to the Maine Secretary of State. This can often be done online for convenience.

- Pay the Required Fee: There is a filing fee associated with the Articles of Incorporation. Ensure that you include payment to avoid processing delays.

- Review for Accuracy: Double-check all information for accuracy before submission. Errors can lead to delays or rejection of your application.

- Keep a Copy: After filing, retain a copy of the Articles of Incorporation for your records. This document is vital for future business operations.

By following these key takeaways, you can navigate the process of incorporating in Maine more effectively.

Instructions on Filling in Maine Articles of Incorporation

Once you have the Maine Articles of Incorporation form in hand, you can begin the process of filling it out. This form is essential for establishing your business as a corporation in Maine. After completing the form, you will submit it to the appropriate state agency, along with any required fees. Be sure to double-check your information for accuracy before submission.

- Start by entering the name of your corporation. Make sure it is unique and complies with Maine naming requirements.

- Provide the purpose of your corporation. This should be a brief statement describing what your business will do.

- Fill in the address of your corporation's principal office. This should be a physical address, not a P.O. Box.

- List the name and address of the registered agent. This person or business will receive legal documents on behalf of your corporation.

- Indicate the number of shares your corporation is authorized to issue. Specify the class of shares if applicable.

- Include the names and addresses of the incorporators. These individuals are responsible for filing the Articles of Incorporation.

- Sign and date the form. The incorporators must sign to validate the document.

- Review the completed form for accuracy and completeness.

- Prepare the filing fee, which must accompany your submission.

- Submit the form and payment to the Maine Secretary of State's office, either by mail or in person.

Other Maine Forms

Maine Homeschooling Laws - Your child’s educational path begins with submitting a complete and accurate Letter of Intent.

Divorce Settlement Template - The agreement sets forth how property, debts, and spousal support will be handled between the divorcing spouses.

A New York Lease Agreement form is a legal document that outlines the terms and conditions between a landlord and a tenant for renting residential or commercial property. This essential tool provides clarity and protection for both parties, detailing rights, responsibilities, and expectations. Understanding this form is critical for anyone involved in a rental arrangement in New York, and you can find more information on this topic through various resources, including Templates and Guide.

Notary Witness Signature Form - The form can be used in estate planning documents like wills and trusts.

Learn More on This Form

-

What are the Articles of Incorporation?

The Articles of Incorporation are a legal document that establishes a corporation in Maine. This document outlines essential information about the corporation, including its name, purpose, registered agent, and the number of shares it is authorized to issue. Filing this document is a crucial first step in forming a corporation in the state.

-

Who needs to file Articles of Incorporation?

Any individual or group looking to form a corporation in Maine must file Articles of Incorporation. This includes businesses seeking to operate as a corporation, whether for profit or non-profit. If you are forming a limited liability company (LLC) or another type of business entity, different forms will be required.

-

What information is required in the Articles of Incorporation?

The form typically requires the following information:

- The name of the corporation.

- The purpose of the corporation.

- The address of the corporation's principal office.

- The name and address of the registered agent.

- The number of shares the corporation is authorized to issue.

- The names and addresses of the incorporators.

-

How do I file the Articles of Incorporation?

To file the Articles of Incorporation in Maine, you can submit the form online through the Maine Secretary of State's website or mail a completed paper form to the appropriate office. Be sure to include the required filing fee, which varies depending on the type of corporation being formed.

-

What is the filing fee for the Articles of Incorporation?

The filing fee for the Articles of Incorporation in Maine varies based on the type of corporation. As of October 2023, the fee is typically around $145 for a for-profit corporation and $50 for a non-profit corporation. It's important to check the Maine Secretary of State's website for the most current fee information.

-

How long does it take to process the Articles of Incorporation?

Processing times can vary. Generally, online submissions are processed more quickly, often within a few business days. Paper submissions may take longer, sometimes up to two weeks. For expedited service, there may be additional fees, so it's advisable to check the latest processing times on the Maine Secretary of State's website.

-

Can I amend the Articles of Incorporation after filing?

Yes, amendments can be made to the Articles of Incorporation after the initial filing. To do this, you must file an amendment form with the Maine Secretary of State and pay any applicable fees. Common reasons for amendments include changes in the corporation's name, purpose, or structure.

-

What happens if I don’t file the Articles of Incorporation?

If you fail to file the Articles of Incorporation, your business will not be legally recognized as a corporation in Maine. This can lead to personal liability for business debts and obligations. Additionally, you will miss out on the benefits of limited liability protection that a corporation provides.

PDF Form Information

| Fact Name | Description |

|---|---|

| Purpose | The Maine Articles of Incorporation form is used to legally establish a corporation in the state of Maine. |

| Governing Law | This form is governed by Title 13-B of the Maine Revised Statutes, which outlines the laws for corporations. |

| Filing Requirement | To create a corporation, the Articles of Incorporation must be filed with the Maine Secretary of State. |

| Information Needed | Key details such as the corporation's name, purpose, and registered agent must be included in the form. |

| Filing Fee | A filing fee is required when submitting the Articles of Incorporation, which varies based on the type of corporation. |

| Amendments | If changes are needed after filing, amendments to the Articles of Incorporation can be submitted to the Secretary of State. |

Documents used along the form

When forming a corporation in Maine, several important documents complement the Articles of Incorporation. These documents serve various purposes, from establishing internal governance to ensuring compliance with state regulations. Below is a list of common forms and documents that you may need alongside the Articles of Incorporation.

- Bylaws: These are the rules that govern the internal management of the corporation. Bylaws outline how the corporation will operate, including the roles of officers and directors, meeting procedures, and voting rights.

- Initial Report: This document provides the state with essential information about the corporation shortly after its formation. It typically includes details about the corporation's officers and registered agent.

- Recommendation Letter Form: To gather endorsements effectively, utilize our comprehensive Recommendation Letter template for accurate and impactful assessments.

- Employer Identification Number (EIN) Application: Also known as Form SS-4, this application is submitted to the IRS to obtain an EIN. This number is necessary for tax purposes and is required for hiring employees.

- Registered Agent Consent Form: This form confirms that the registered agent has agreed to serve in that capacity. It is important for ensuring that the corporation has a reliable point of contact for legal documents.

- Business License Application: Depending on the type of business and location, a specific license may be required to operate legally. This application varies by city and industry.

- Operating Agreement (for LLCs): If forming a Limited Liability Company (LLC), an operating agreement outlines the management structure and operating procedures of the LLC, similar to bylaws for corporations.

- Stock Certificates: If the corporation issues stock, stock certificates may be created to represent ownership in the company. These documents are important for shareholders and record-keeping.

- Meeting Minutes: Documentation of decisions made during meetings of the board of directors or shareholders. Keeping accurate minutes is crucial for legal compliance and organizational transparency.

- State-Specific Forms: Depending on the nature of the business, additional forms may be required by the state, such as forms related to sales tax, permits, or industry-specific regulations.

Gathering these documents can streamline the incorporation process and help ensure compliance with state laws. Each document plays a vital role in establishing a solid foundation for your corporation, allowing it to operate smoothly and effectively.

Misconceptions

The Maine Articles of Incorporation form is an essential document for anyone looking to establish a corporation in the state of Maine. However, several misconceptions surround this form that can lead to confusion. Here are four common misunderstandings:

- Misconception 1: The Articles of Incorporation are the only requirement for starting a business.

- Misconception 2: The Articles of Incorporation can be filed at any time without consequences.

- Misconception 3: Anyone can fill out the Articles of Incorporation without any guidance.

- Misconception 4: Once filed, the Articles of Incorporation cannot be changed.

Many believe that filing the Articles of Incorporation is all that is needed to start a business. In reality, while this form is crucial, additional steps such as obtaining necessary licenses, permits, and registering for taxes are also required to operate legally.

Some people think they can file the Articles of Incorporation whenever they want. However, timing can be critical. Delays in filing may affect business operations, especially if there are existing contracts or agreements that require the corporation to be officially recognized.

While the form may seem straightforward, it is not advisable for anyone to complete it without proper understanding. Errors or omissions can lead to delays or even rejection of the application. Consulting with a professional can help ensure accuracy and compliance with state laws.

Some believe that the Articles of Incorporation are set in stone once filed. In fact, changes can be made, but they require a formal amendment process. This process ensures that the corporation remains compliant with state regulations and accurately reflects its current structure.

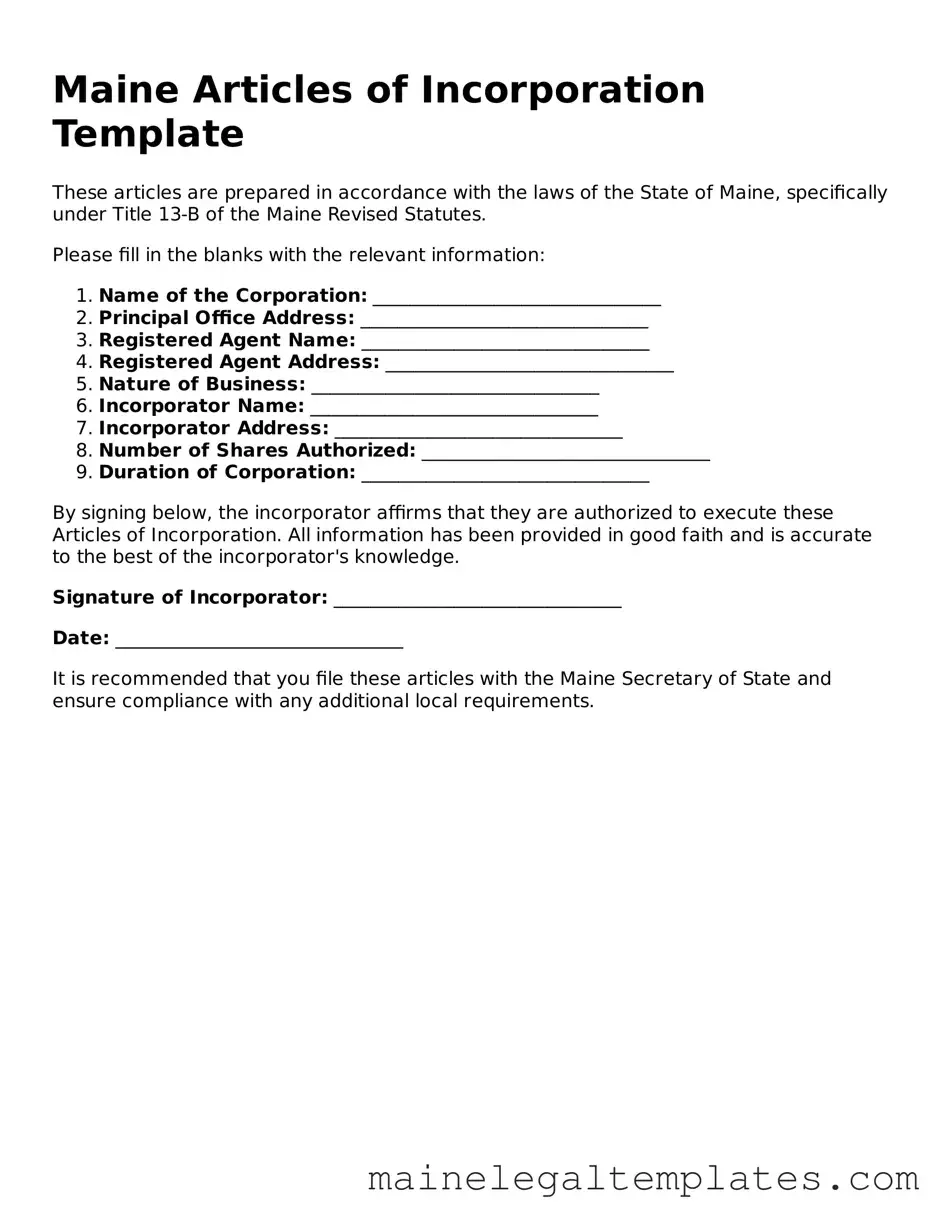

Document Preview

Maine Articles of Incorporation Template

These articles are prepared in accordance with the laws of the State of Maine, specifically under Title 13-B of the Maine Revised Statutes.

Please fill in the blanks with the relevant information:

- Name of the Corporation: _______________________________

- Principal Office Address: _______________________________

- Registered Agent Name: _______________________________

- Registered Agent Address: _______________________________

- Nature of Business: _______________________________

- Incorporator Name: _______________________________

- Incorporator Address: _______________________________

- Number of Shares Authorized: _______________________________

- Duration of Corporation: _______________________________

By signing below, the incorporator affirms that they are authorized to execute these Articles of Incorporation. All information has been provided in good faith and is accurate to the best of the incorporator's knowledge.

Signature of Incorporator: _______________________________

Date: _______________________________

It is recommended that you file these articles with the Maine Secretary of State and ensure compliance with any additional local requirements.